A Picture of Resilience, CLO ETFs Cross $10 Billion

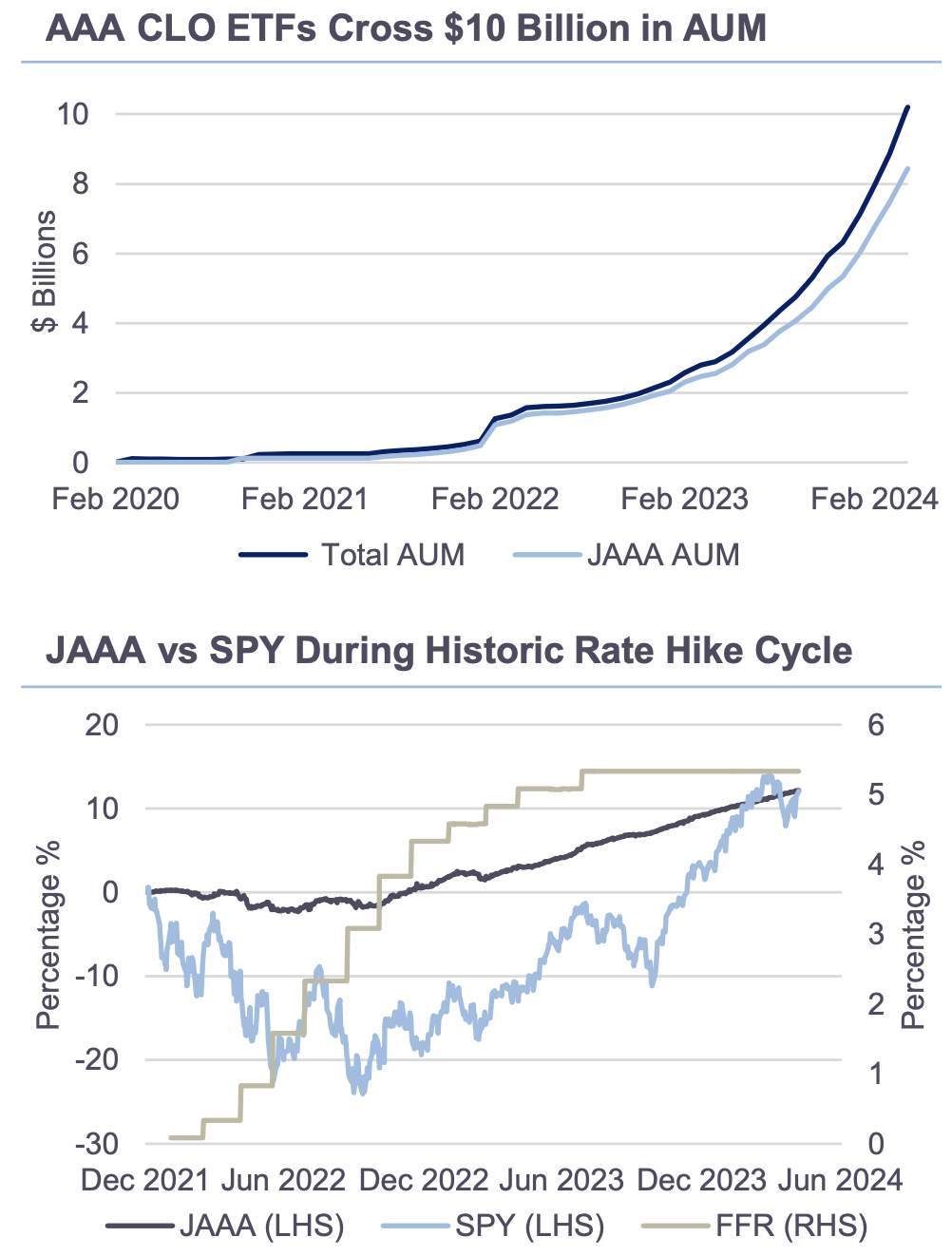

The floating-rate feature of Collateralized Loan Obligations (CLOs) has commanded the appeal of retail investors. Strong performance versus equities and favorable credit profiles versus corporates are notable highlights. This is evident in the rapid growth of CLO ETFs, crossing the $10bn assets under management (AUM) mark.

The Conversation

CLOs are primarily an institutional asset class, used as a funding vehicle for leveraged loans made to sub-investment grade businesses. Unlike the fixed-rate terms extended on debt of investment grade companies, leveraged loan debt bears floating-rates. This serves as the collateral for CLOs, securities carrying floating- rate coupons rated AAA and below. The historic Federal Reserve rate hiking cycle has led to the appeal of CLOs by retail investors as seen by the steady growth of the leading ETF investing in AAA-rated CLOs, Janus Henderson (NYSEARCA: JAAA).

Drawing increased attention to this ETF is its relative strong performance to the equity market; on a cumulative basis, the JAAA ETF has modestly outperformed the S&P 500 Index since the onset of rate hikes in early 2022. Looking ahead, the economic narrative and the resulting Federal Reserve reaction function, to hike, hold, or ease, stands to drive flows and the return profile of JAAA, and its recently launched JBBB, investing in the lower-rated CLO tranches.

The Rithm Take

At a time when the Federal Reserve’s monetary policy is in flux, CLO ETF flows and performance provides another sentiment indicator from the retail investor base in addition to data points from capital markets. Economic resilience should support continued inflows and performance in these ETFs. A hard landing, on the other hand, could prompt outflows in both, imparting volatility in CLO valuations and testing the historically lower default rates versus corporate credit and track record of no impairments to AAA and AA CLOs. A soft landing outcome could show varying flows between JAAA and JBBB on shifting appetite for credit risk.