A Rate Cut is Locked and Loaded but Will it Be One Barrel or Two?

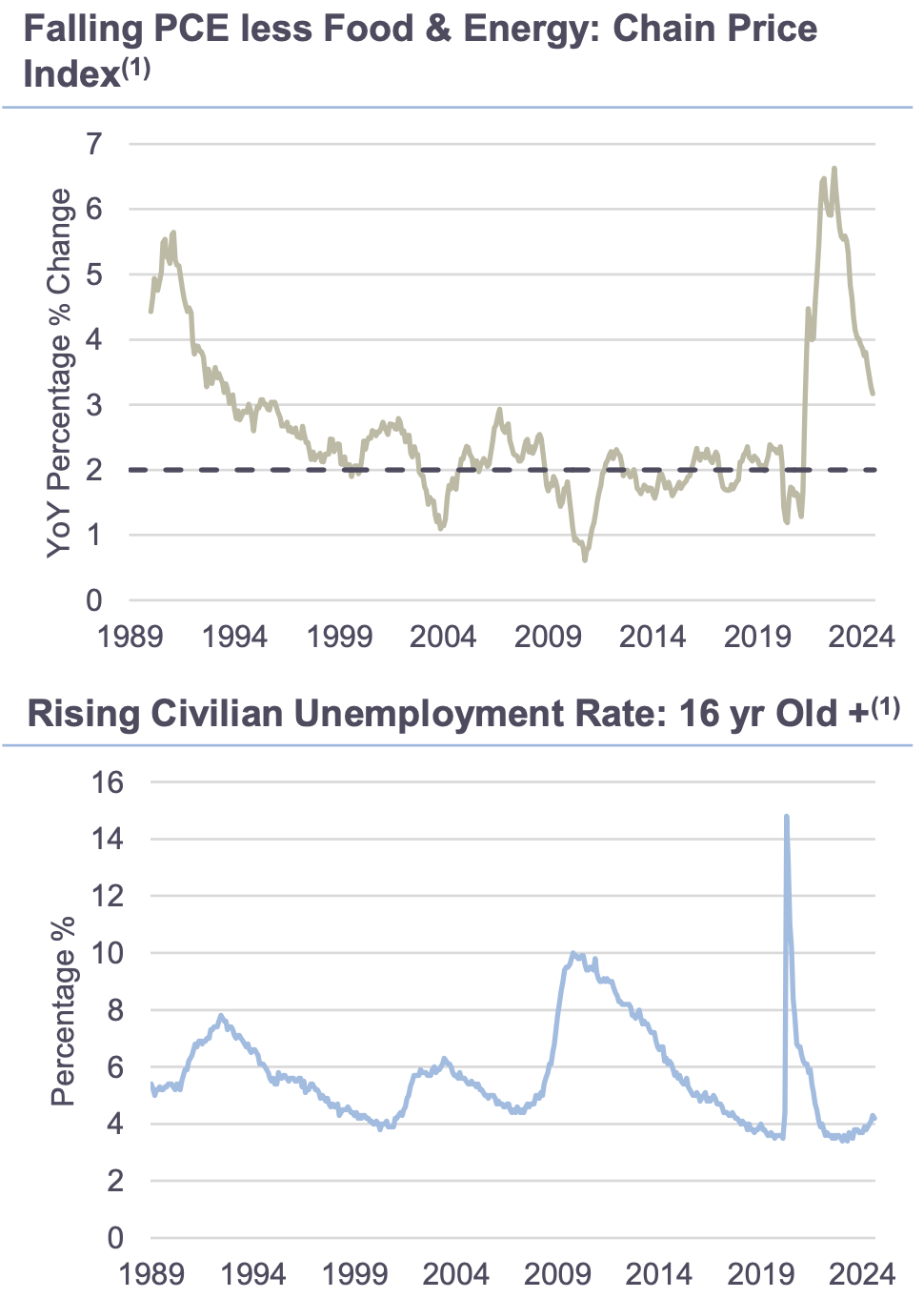

Fed Chair Powell and other Fed officials have essentially said that a rate cut is expected at the conclusion of the September 17-18 policy meeting. Speaking on Friday after the August jobs report, Governor Waller used the term "cut" 16 times throughout his speech, making statements such as "The current batch of data no longer requires patience, it requires action" and "There is sufficient room to cut the policy rate and still remain somewhat restrictive to ensure inflation continues on the path to our 2 percent target." With both headline and core PCE price inflation having slowed to around 2.5% in July and with the unemployment rate rising from a low of 3.4% to 4.2% in August, the balance of risks between the Fed’s price-stability mandate and the maximum employment mandate has become much more even. Correctly implemented forward-looking policy would argue for a reduction in the degree of monetary restraint.

The Conversation

With a rate cut later this month all but assured, the question is what will be the size of the cut? At the July post-FOMC press conference, Powell suggested that a half-point cut would be unlikely, saying, "That’s not something we’re thinking about right now." However, at his Jackson Hole appearance, with the July employment report that showed an increase in the unemployment rate to 4.3% in hand, Powell would not rule out a half-point cut, saying, "The direction of travel is clear and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks." Waller also left the door open to a larger first rate cut when he said, "Determining the pace of rate cuts and ultimately the total reduction in the policy rate are decisions that lie in the future. As of today, I believe it is important to start the rate cutting process at our next meeting."

Fed policymakers have argued that the decision does not depend on any one data point, and Waller said, "I am open-minded about the size and pace of cuts, which will be based on what the data tell us about the evolution of the economy." Waller also said, "While I expect that these cuts will be done carefully as the economy and employment continue to grow in the context of stable inflation, I stand ready to act promptly to support the economy as needed." So, which is it to be?

The Rithm Take

We have argued that rate cuts prompted by declining inflation would be neither rapid nor larger than quarter-point steps as the Fed tries to calibrate the stance of policy to bring inflation down to 2%. However, if the economic data points to recession, then we would expect more rapid and sizeable cuts. Neither policymakers nor ourselves see the economy in recession and at this stage, we expect only a quarter-point cut on September 18. The latest core CPI print of 0.3% for August, may be the data point that pushes the FOMC to that outcome.