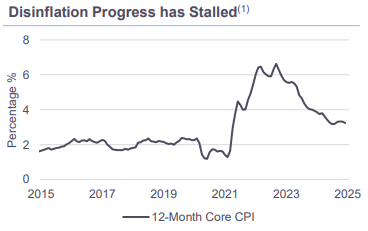

As Disinflation Stalls, Unemployment Drops

The Federal Open Market Committee will conclude its two-day monetary policy meeting on Wednesday and it is almost universally expected that the Fed funds target range will be held steady 4.25% - 4.5%. This would represent a shift in the Fed’s monetary policy strategy from “recalibrating” (read reducing) the degree of restrictiveness of monetary policy regardless of the data to making the policy rate dependent on further progress in lowering inflation towards the Fed’s 2% target. There will be no new Summary of Economic Projections, which in December showed two quarter-point rate cuts in 2025 on the median dot.

The Conversation

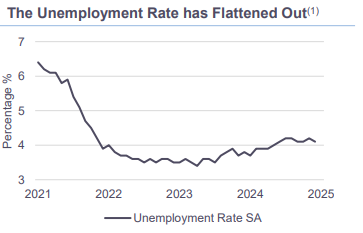

The Fed adopted the word "recalibration" to describe its 100bps of rate cuts in late 2024. The desire to reduce the degree of monetary restraint was no doubt driven by the rise in the unemployment rate in July to 4.3%, which may have sparked fears of an undesirably sharp slowing in the economy or even an emerging recession. However, this increase in the unemployment rate has been revised down to 4.2% and the rate ended the year at 4.1%. Essentially, the unemployment rate moved sideways in the second half of last year.

At the September FOMC meeting, the Fed was also predicting 2.6% core PCE price inflation for 2024. Based on data through November, it appears that the increase in core prices in 2024 is likely to be 2.8%, which would mean that core inflation ended the year higher than it was recorded in June. Fed policymakers have signaled that further reductions in the policy rate hinge on the resumption of progress in getting underlying inflation down towards the 2% target. Furthermore, in September the median projection for the unemployment rate was 4.4% but the rate ended the year at 4.1%. The Fed delivered the 100bps recalibration in the funds rate against the backdrop of higher-than-expected inflation and lower than expected unemployment.

The Rithm Take

One can consider the appropriate calibration of the policy rate using a Taylor Rule that calculates this rate in terms of an inflation rate and the unemployment rate. The standard version of this rule put the appropriate policy rate 70bps higher at the end of 2024 than realization of the September SEPs would have warranted, yet the Fed still delivered the 100bps of cuts in those SEPs. It seems likely that policy will be on hold for some time as the Fed waits for evidence that inflation has resumed its downtrend.