Data to Watch: Momentum and Breadth of Inflation Moderation

Swift Momentum, Widening Breadth

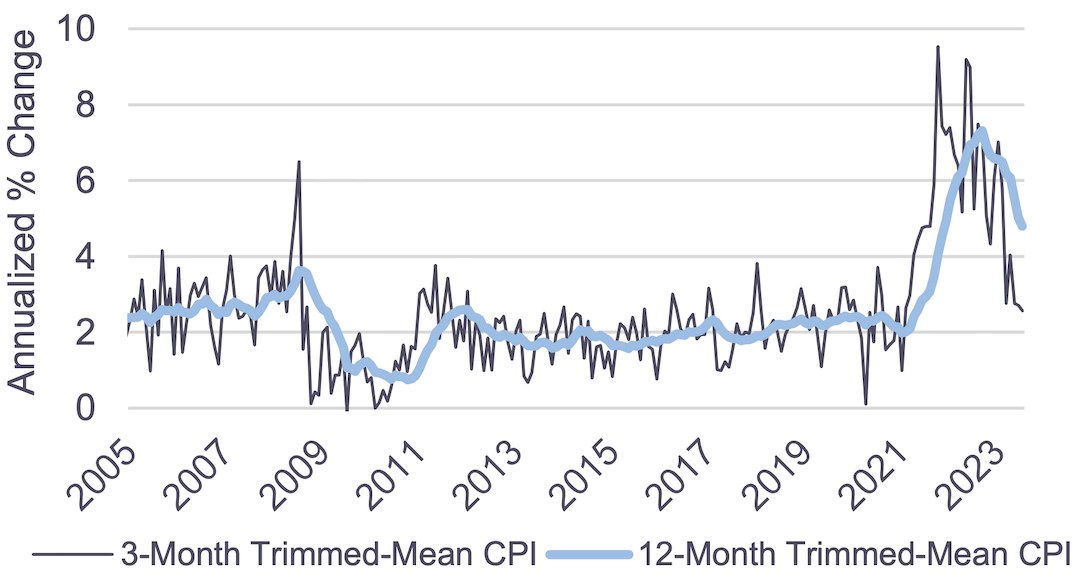

Disinflation is here, based on momentum of moderation and easing in the breadth of inflation metrics. As seen in the left chart below, the rapid pace of moderation is evident in the 3-month readings of the Cleveland Fed’s Trimmed-Mean CPI, compared to the 12-month pace. As seen in the right chart below, a wider complex of key inflation metrics have been easing over the last year.

FRB Cleveland 16% Trimmed-Mean CPI(1)

Share of CPI Components with 5%+ 1-month Annualized Growth(2)

Expectations are for inflation to continue to decline. This week the Federal Reserve Bank of New York’s monthly survey of inflationary expectations showed one-year-ahead and three-year-ahead expected inflation to decline to 3.6% and 2.9%, respectively. Longer term 10-year inflation expectations, as implied from the bond markets, is priced at 2.35%. To put this into perspective, current inflation is 3.2%, down from 2022’s high of 9%.

Should these disinflation expectations be realized, especially if CPI heads towards 3%, the chances of a Fed policy pivot rise. The New York Fed President John Williams in an August 2 New York Times article said, “Assuming inflation continues to come down […] next year, as many forecast (including the FOMC members), if we don’t cut interest rates at some point then real interest rates will go up, and up, and up. That won’t be consistent with our goals.” We previously covered this outlook of “passive tightening” here.

Inflation Ahead

Some of the moderation in inflation in recent months can be attributed to travel-related sectors. Hotel prices have declined in three of the last four months of CPI data, while airfares are 18.6% below year-ago levels. Lower travel-related prices are at odds with industry reports, making it unlikely that this sector will be an ongoing source of disinflationary pressure in the CPI. Rent is a key component that should contribute to further easing in CPI services prices. It is important to note that CPI rents lag market rents due to the staggered repricing of leases. Therefore, we expect to see the effects of the current slowing of market rents in upcoming CPI.

Bigger picture, a sustained moderation in inflation will depend on whether the Fed has achieved – and will maintain – a restrictive stance of monetary policy.

The Rithm Take

Much hinges on this outlook for inflation, and the Fed’s reaction function. Credit stresses are building through lower debt coverage ratios on leveraged loans and high leverage by CRE sponsors, challenged by rising debt service costs. The longer high policy rates prevail, the higher the chances of defaults rising and financial conditions tightening. Falling inflation, a pivot to Fed easing, on the other hand, could soften this blow.