Fed on Hold, Tariffs Loom Large

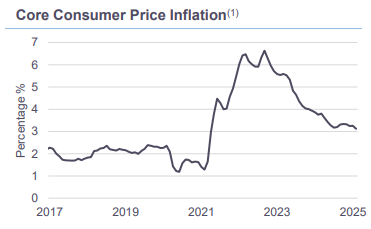

The Federal Open Market Committee (FOMC) will conclude its next policy meeting on Wednesday and is widely expected to keep interest rates on hold. Policymakers have signaled they are in no hurry to cut rates again and want to see more progress in bringing inflation closer to the committee's 2% PCE price inflation target before doing so. Although the February CPI report showed a slight drop in core inflation—from the 3.2%-3.3% range since last June to 3.1%—that improvement alone is not enough to prompt a rate cut. Meanwhile, ongoing Executive Orders on tariffs add uncertainty to inflation and growth prospects, likely pulling the Fed in different directions as 2025 unfolds.

The Conversation

The Federal Reserve has two mandates: price stability—defined as a 2% inflation target (measured by PCE prices)—and maximum employment, which the Fed associates with a 4.2% unemployment rate. Because core inflation stalled from June of last year through January and only edged down in February (as measured by the CPI), and with the unemployment rate at 4.1% in the same month, it would be a shock if the Fed did anything other than keep the federal funds target rate unchanged at 4.25%-4.5%.

FOMC participants will also submit new forecasts for growth, unemployment, inflation, and the policy rate ahead of the meeting. Tariffs and other policies of the new administration make this exercise more difficult than usual. Chair Powell has noted that the Fed must respond to the net effect of all policies, but turmoil in the stock market due to tariffs is fueling concerns about a possible recession. While the Fed may trim its median growth forecast slightly below the current 2.1% for 2025, it seems unlikely any cut will exceed a few tenths of a percent. Meanwhile, tariffs raise the prices of imported goods, so a small upward revision to the 2025 core inflation forecast from 2.5% is also possible.

The Rithm Take

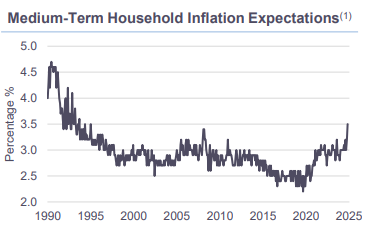

Tariff policy has become the "elephant in the room" for the Federal Reserve, shifting risks toward lower growth and higher inflation in 2025. Because tariffs pull growth and inflation in different directions, they complicate monetary policy decisions. The Fed may look past higher prices if it considers them temporary rather than part of an ongoing inflation trend. To assess this, the Fed will closely monitor inflation expectations. Notably, the University of Michigan's measure of household medium-term inflation expectations rose to 3.5% in February, up from 3.2%; a preliminary reading for March is due Friday. In December, the Fed saw two rate cuts as appropriate for 2025, but questions at the upcoming press conference will likely focus on the risks to that forecast.