Fed Will Likely Cut a Quarter-Point on Thursday; Outlook Depends on Data

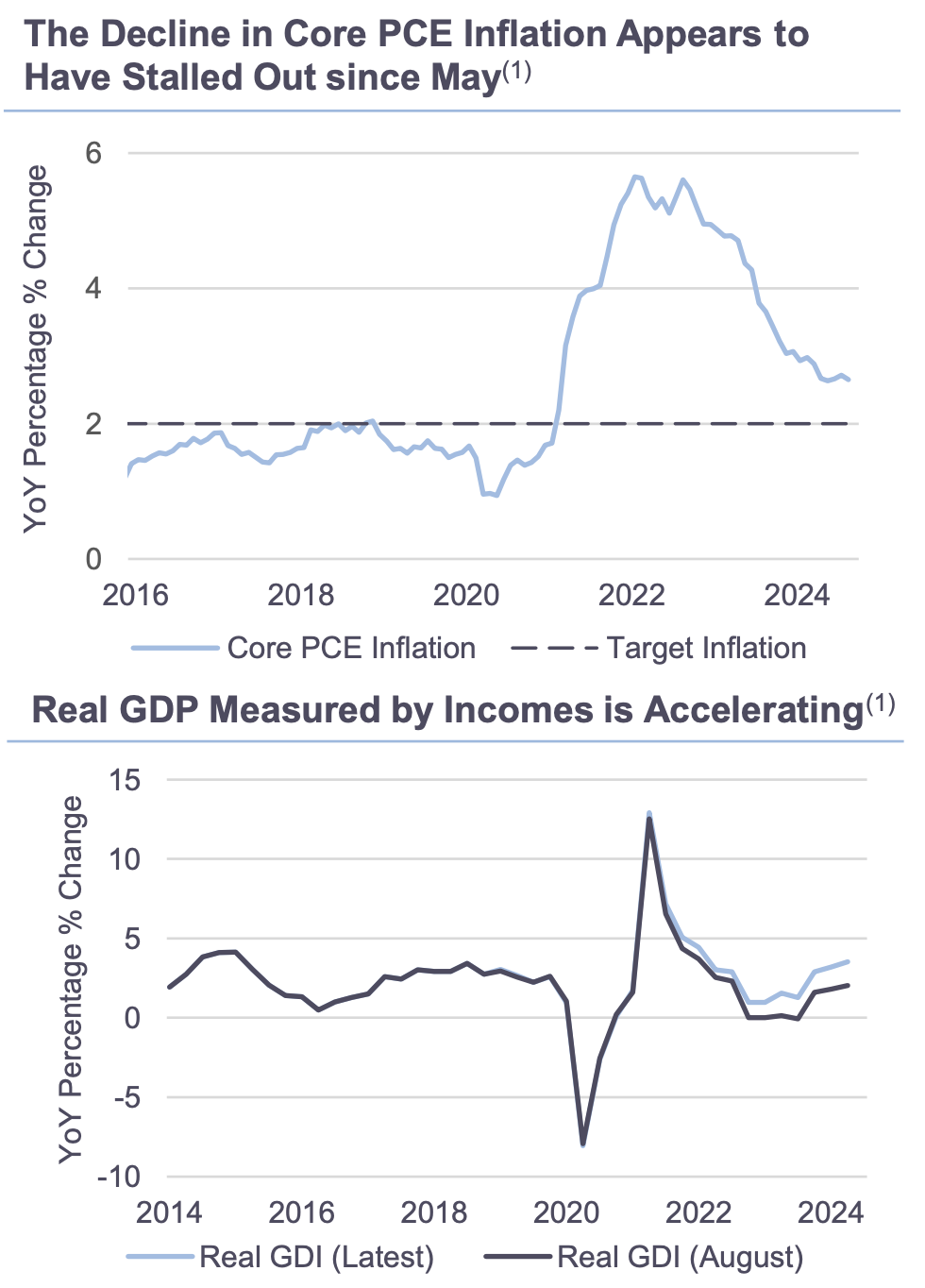

The economic data that has been released since the Fed’s aggressive half-point cut in rates on September 18 have cast that decision in an unfavorable light. The GDP report for September found significantly more profit and wage income than had been previously reported (2.0%) and showed the income estimate of real GDP growing by 3.5% over the four-quarter period ended June. Last week’s third-quarter report showed the expenditure estimate of real GDP growing at 2.8% in the quarter. Core PCE price inflation, at 2.7% in September, has not fallen since May on a year-over-year basis. These observations on growth and prices question just how restrictive monetary policy is and therefore, how much room the Fed has to lower interest rates. The Fed is expected to move cautiously, lowering rates a further quarter point on Thursday, which would put the target range at 4.5% - 4.75%.

The Conversation

There is virtually unanimous agreement among economists and market participants that the Fed will cut by a further quarter point this week. However, the strength of recent economic data and the stickiness of the core inflation rate since May raises questions about just how restrictive monetary policy is and therefore, how much room the Fed has to cut interest rates going forward. Interest rate futures have already revised higher the estimated year-end 2025 policy rate from 2.9% when the Fed concluded its last policy meeting on September 18 to 3.6% by this past Monday. The Fed does not provide new formal guidance in the form of a revised Summary of Economic Projections until December 18, so informal guidance will have to come from Chair Powell at the press conference. He is likely to say that policy decisions are dependent on future data for inflation, unemployment and growth.

The future path for Fed policy will depend on how economic data unfolds in the fourth quarter and in 2025. The end point of the path will also depend on the unobservable neutral real rate of interest. The median estimate of that rate among policy officials is 0.9% but the market has raised the 10-year real interest rate in the TIPS market from 1.6% on September 18 to 2.0% at present. The path for the policy rate will also likely depend on fiscal policy, which is dependent on the outcome of the elections.

The Rithm Take

In the face of uncertainties over the economy, inflation, and fiscal policy, we expect the Fed to move cautiously. Speeches by policymakers appear to have cemented in place a quarter-point cut on Thursday. Going further out, if the strong growth momentum persists and if the economy fails to make more progress on inflation towards the Fed’s 2% target, then we see limited room for further reductions in interest rates next year. If the Fed continues to push down on the policy rate in 2025, we would be concerned about a potential pickup in inflation.