Knock-On Effects

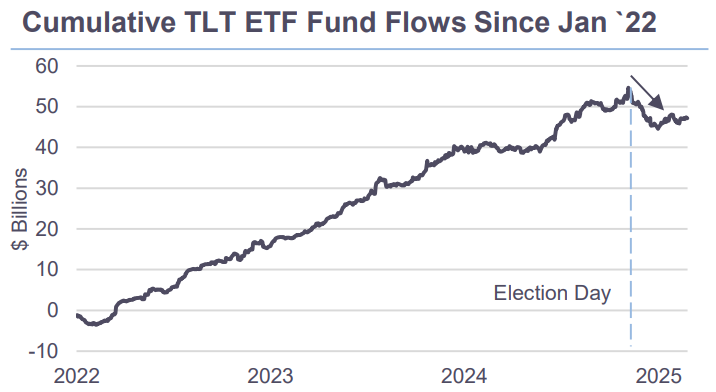

Markets are navigating a landscape shaped by both Washington headlines and a focus on US exceptionalism. After two years of steady trends in interest rates, credit and equities, assets are now priced for resilience. A transformation in fundamentals—driven by shifts in geopolitics, changes in federal governance and proposed revised tax laws—is introducing uncertainty and challenging current valuations. Rebalancing from extreme positions is driving daily flows across sectors, while anticipatory effects ripple through the system. This is seen through the net selling in long duration US Treasury ETFs since the election. Inflation expectations and asset prices are already factoring in tariffs before they take effect and overall economic uncertainty has reversed the confidence boost that followed the elections.

The Conversation

US exceptionalism has driven rates higher, tightened credit, and propelled equities to record highs. This wealth effect has further bolstered consumer resilience. Meanwhile, the Federal Reserve—after a two-and-a-halfyear battle to rein in inflation—has adopted a "wait and see" approach, allowing the administration to lead on economic, trade, tax, and immigration policies.

Until these policies are formalized, anticipatory effects are building rapidly. Prices in several regional manufacturing surveys have surged ahead of tariff implementation; for example, the Dallas Fed’s price index is at its highest level since September 2022—a trend echoed by the Empire State and Philadelphia Fed

surveys. Potential tariffs are also pushing consumer inflation expectations to new highs. Against this backdrop, the market is pricing in two rate cuts through 2025, while the MOVE Index (which tracks rate volatility) remains low, reflecting a Fed on hold. However, if the high price readings from manufacturing surveys begin to nudge inflation higher, this stance could reverse. Notably, the 10-year breakeven inflation rate is at the low end of the year-to-date range (2.4 – 2.5%) and but a surge above 2.6% could trigger a risk-off sentiment.

We now await the Richmond Fed’s CFO surveys on the capital expenditure outlook. Any anticipatory decline in capex spending could signal a loss of growth confidence. If sustained, this trend might undermine the productivity gains underpinning US exceptionalism that helped contribute to rising rates and prompt a reevaluation of the long-term neutral rate—the theoretical rate at which Fed policy is neither stimulative nor restrictive.

The Rithm Take

Policy, pricing, and positioning are all shifting gears as a regime change unfolds across the economy. March economic data may not fully capture these dynamics, as it primarily reflects activity through February. Changes in sentiment—such as the impact on jobless claims from federal government terminations—are expected to emerge in data released throughout April.