Markets in Discovery

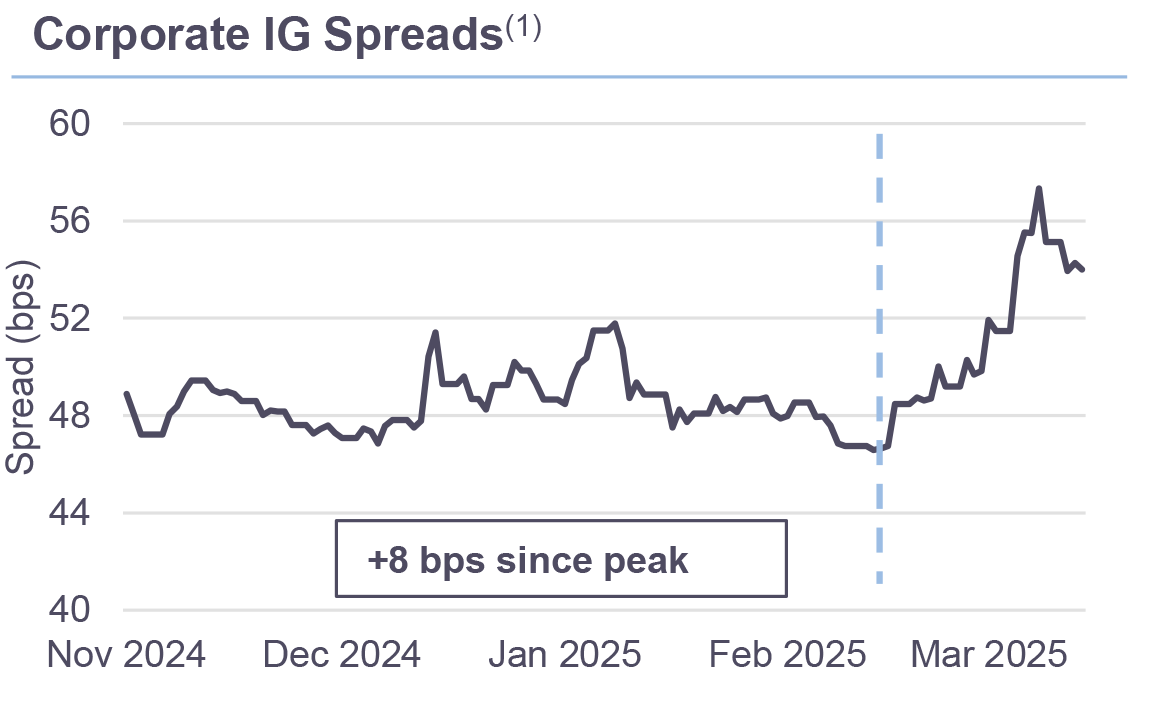

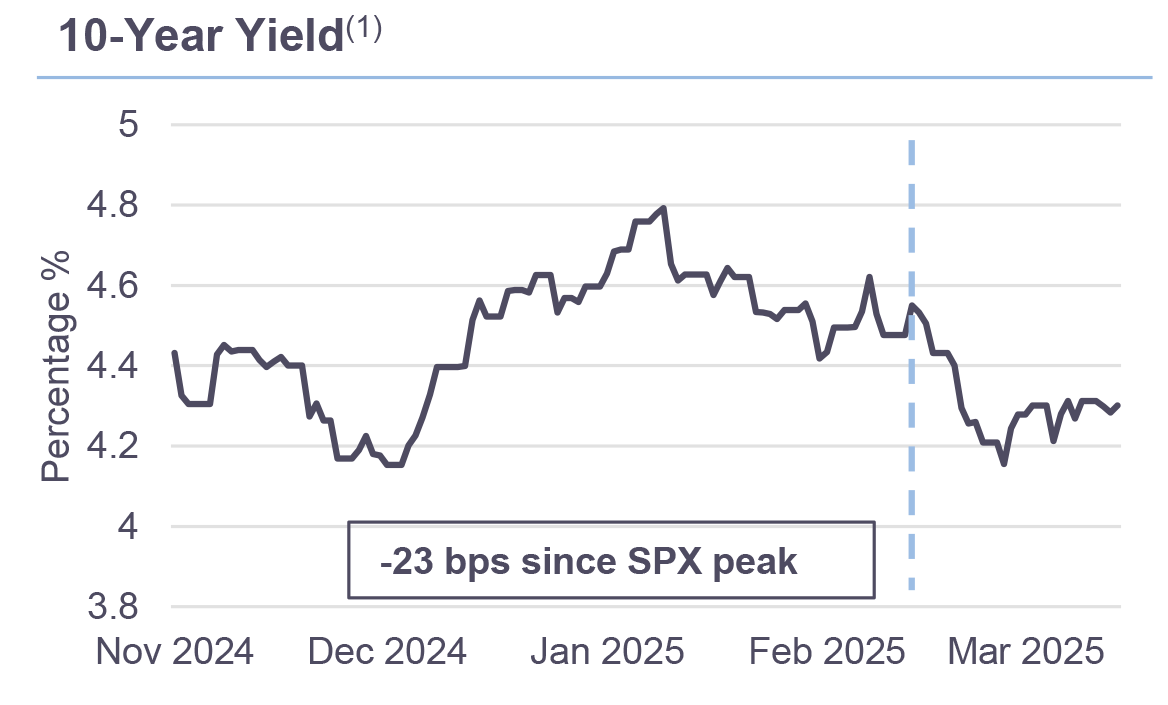

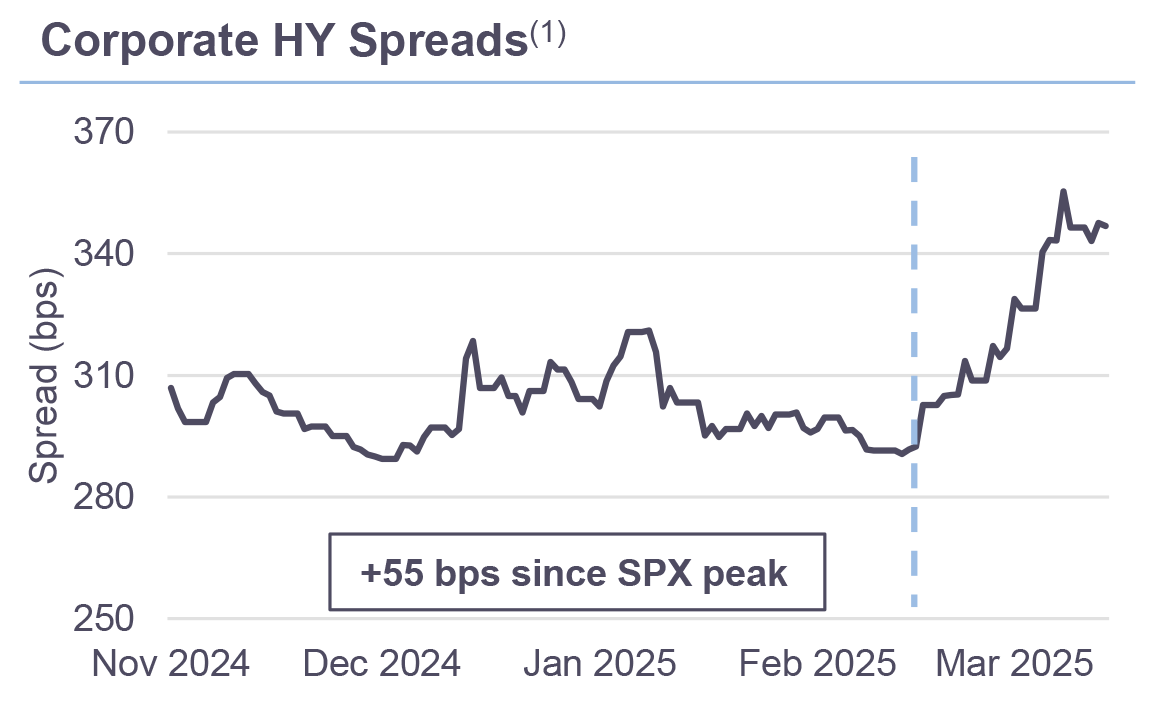

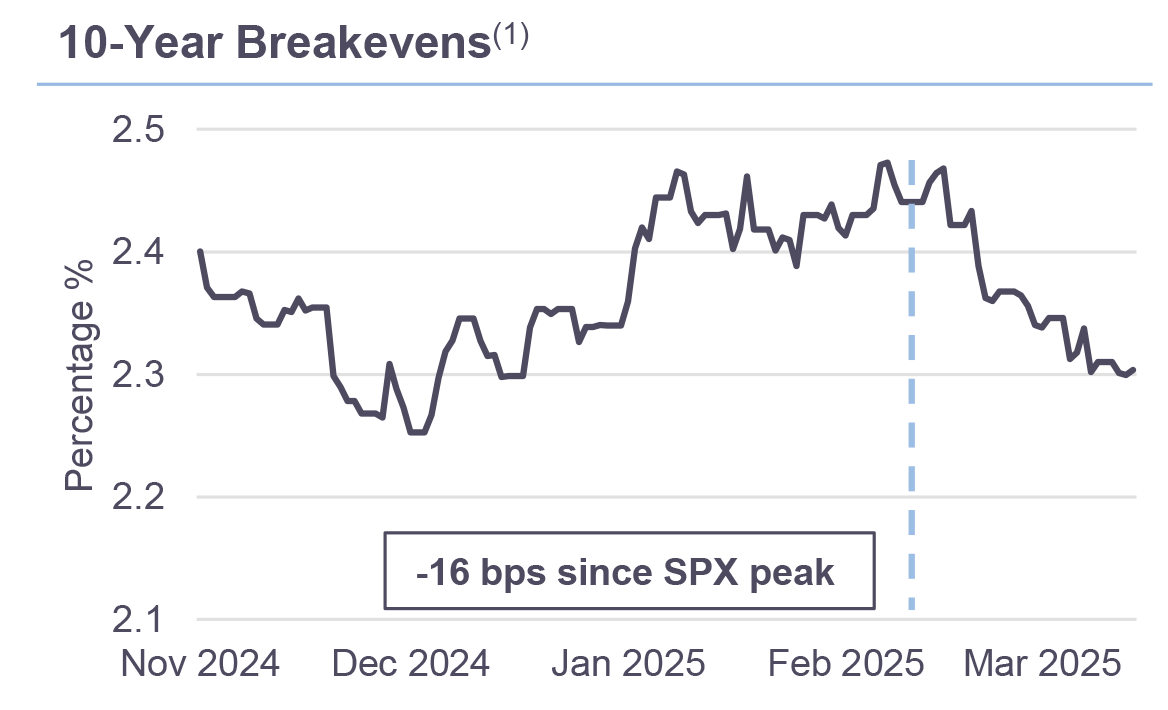

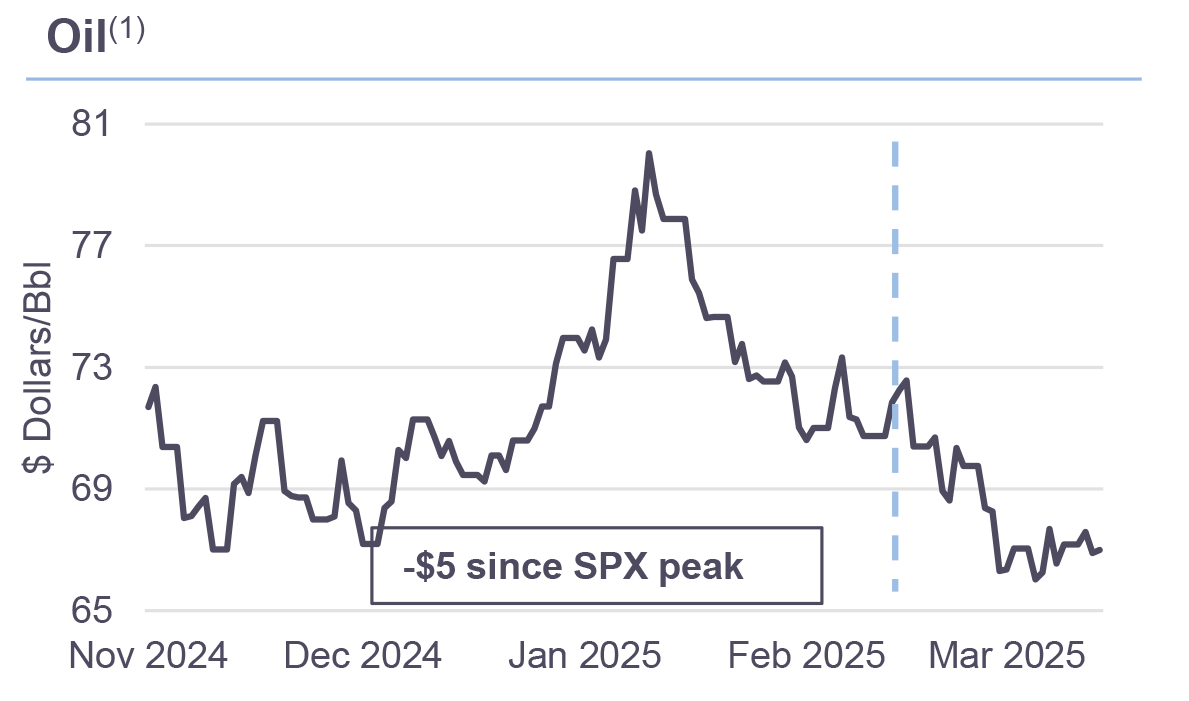

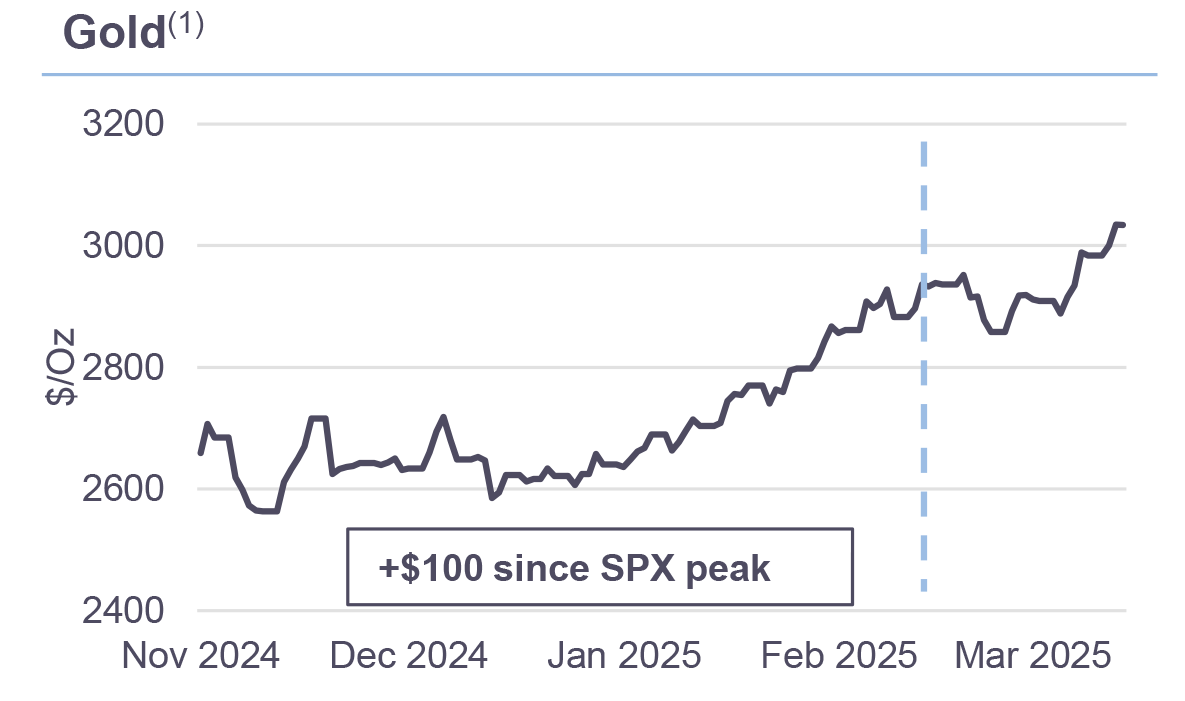

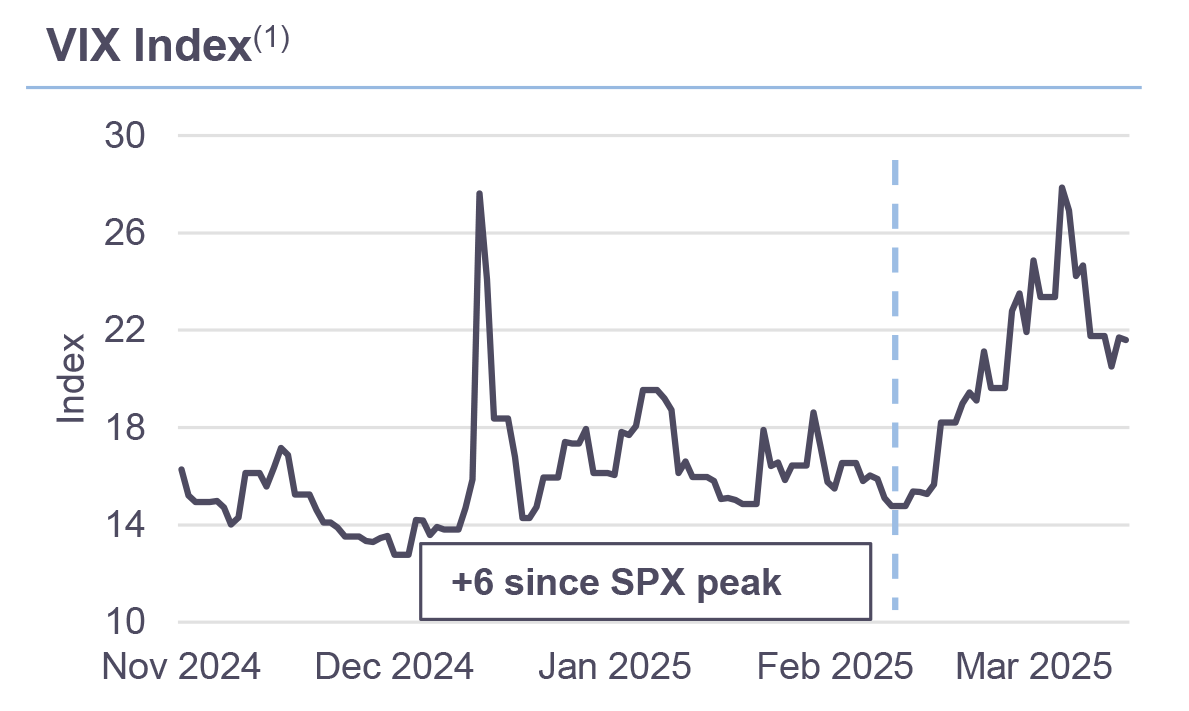

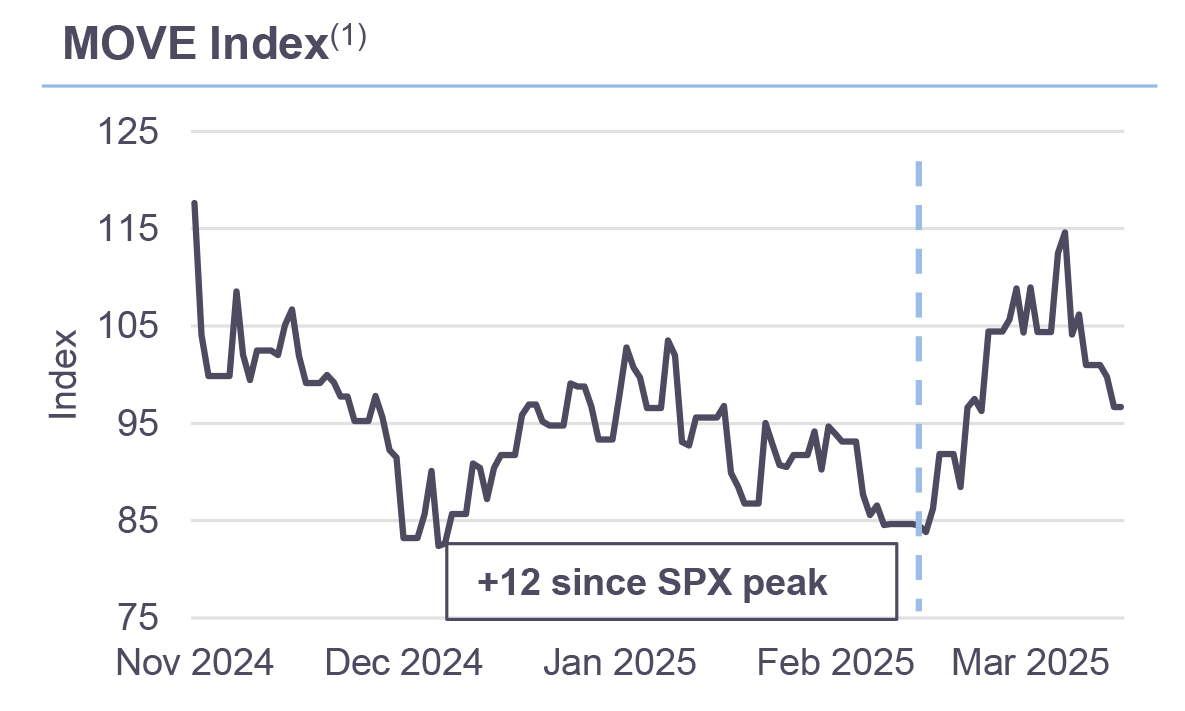

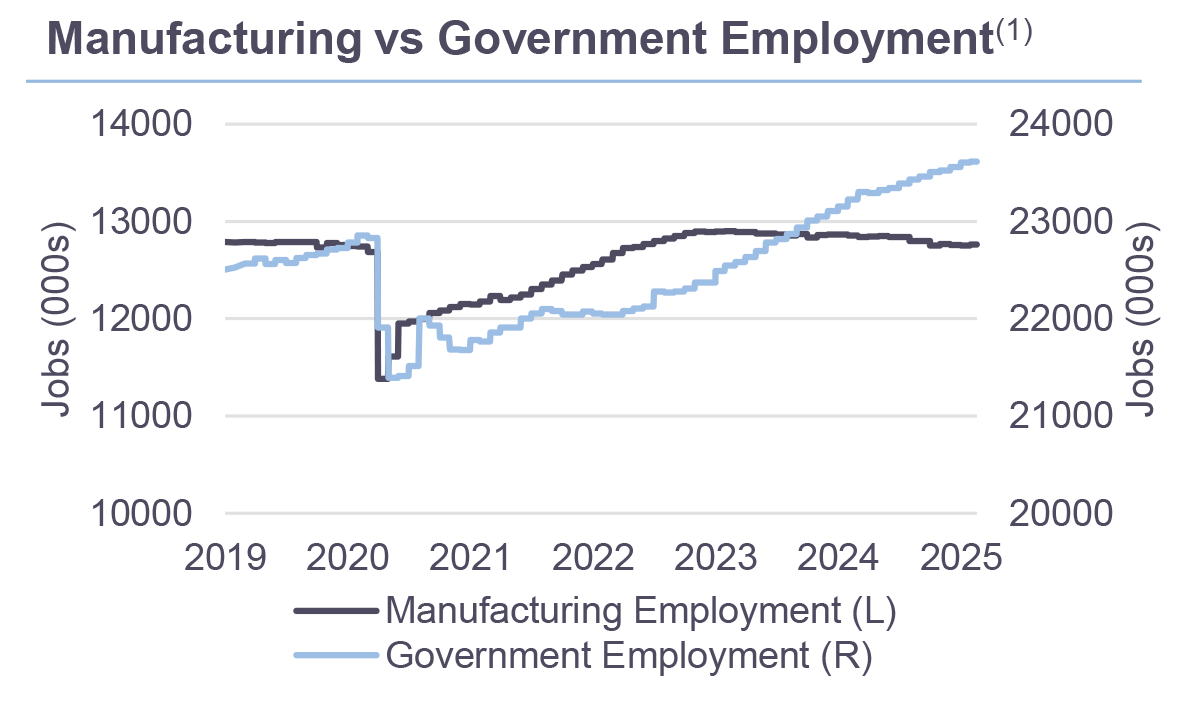

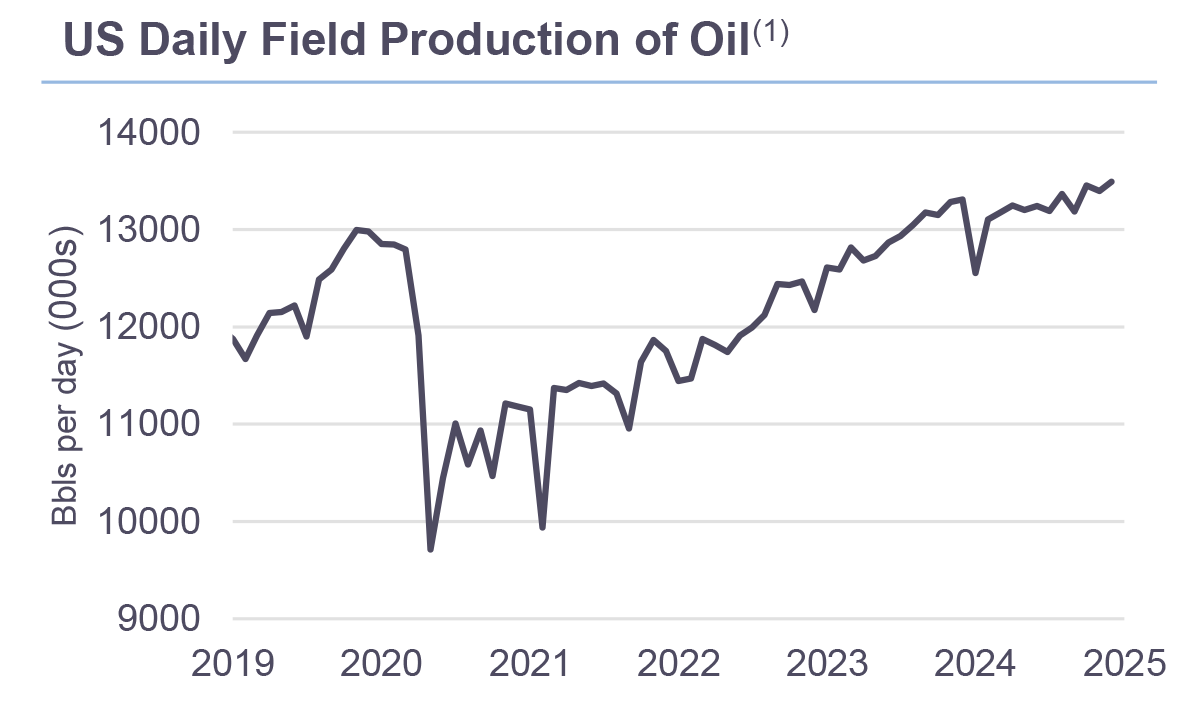

Markets are in a period of discovery, with neither the Trump put nor the Fed put clearly established. Sentiment reflects growing uncertainty around tariff policy and its potential impact on the economy. The Administration is guiding markets and the economy through an adjustment period, while the Fed has raised inflation forecasts and lowered growth projections. Soft data has weakened, though hard data has yet to reflect this shift. We present key market and economic barometers for this transitional phase.

The Rithm Take

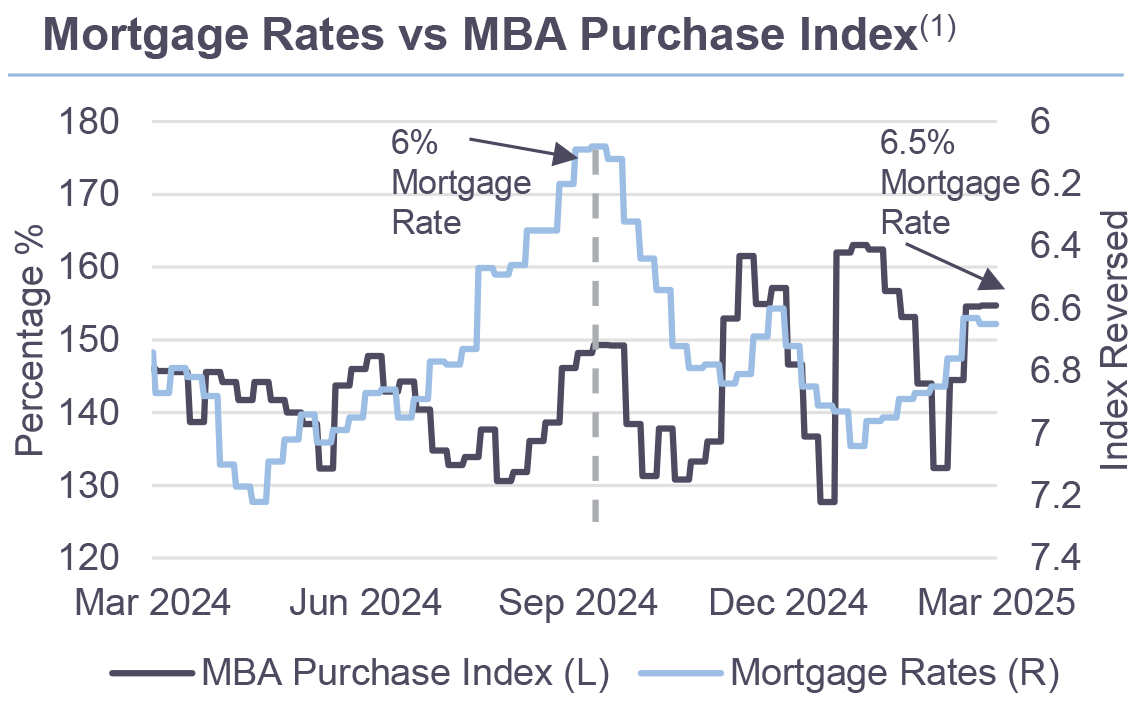

Extracting signals from noise is challenging as economic and market momentum shift into a new paradigm. The weekly mortgage purchase index—representing consumers’ largest purchase—is rebounding to higher levels compared to late last year, when it remained suppressed despite lower mortgage rates. Consumers’ response to these lower rates, through refinancings and purchase volumes, could be a bright spot in this transitional period.