Post-FOMC Flow Show

The September FOMC will be marked as one for the history books. The FOMC’s decision to “recalibrate” policy in easing by 50bps comes against the backdrop of highly accommodative financial conditions, above trend real GDP (and GDI or real GDP based on incomes rather than expenditures that is now even higher), a softening labor market, but no layoffs, and weak sentiment but strong real activity. This backdrop provides a ripe opportunity to extract the message from investor flows.

The Rithm Take

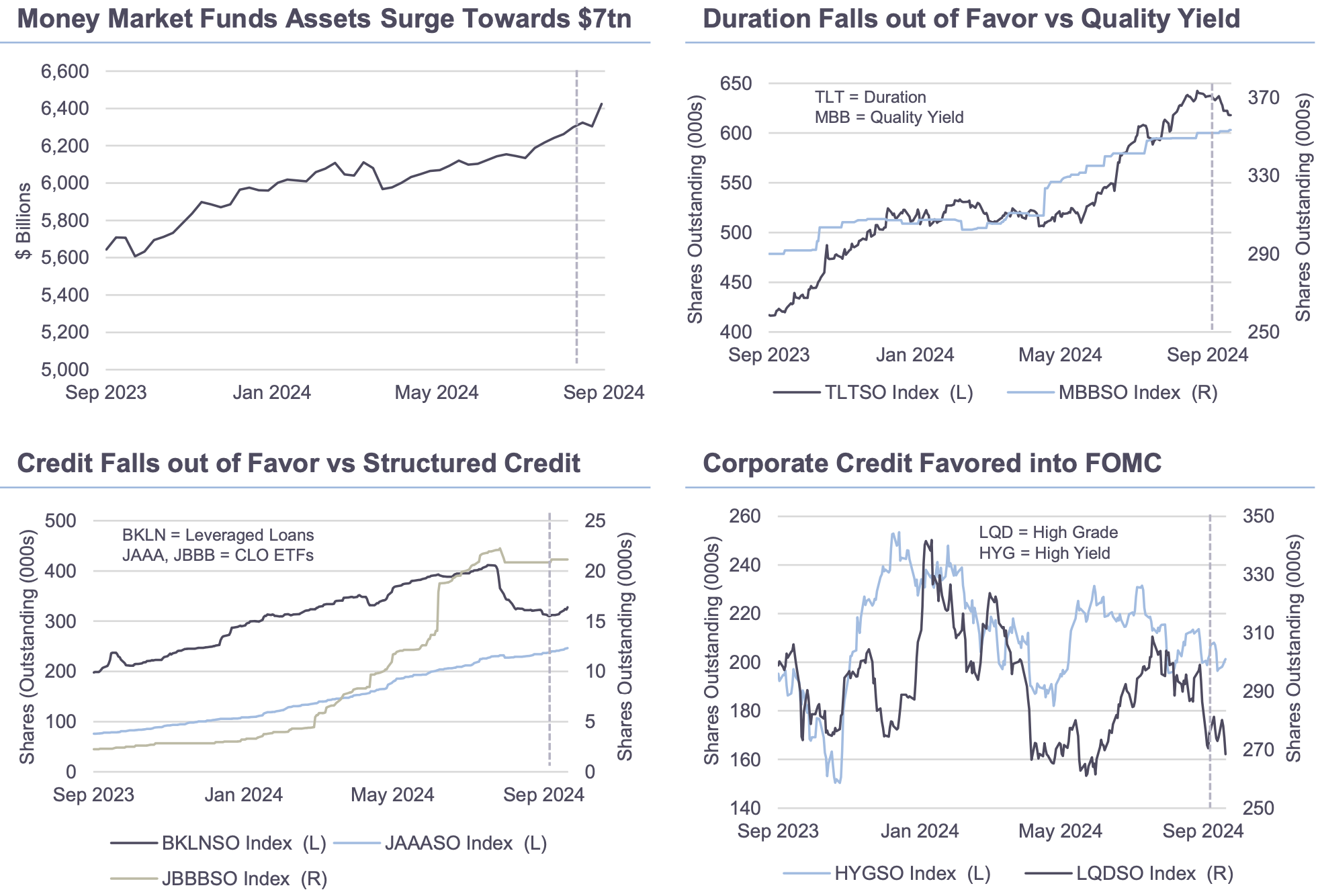

Flows and positioning point to investors shying away from outright duration and direct credit exposures, both favored heading into the September FOMC, but not in emerging out of it. Yield curve steepeners and quality credit assets – from agency MBS to AAA and even BBB CLOs – remain favored assets. This speaks to the continued demand for yield, even given the floating-rate nature of CLO ETFs into lower benchmark rates. Appealing are the credit protections and yield enhancement attributes of a broad range of structured credit assets. Those accessed through public and private markets, institutional and retail offerings, fits into the appetite for quality amidst a backdrop of unresolved economic and monetary policy trends.