Powering the AI Economy

AI has emerged as the new space race—driving fierce competition among companies and nations, especially between the US and China. Breakthroughs like ChatGPT, which reportedly consumes nearly ten times the energy of a typical Google search, signal that the era of flat power demand is over. With energy requirements projected to double over the next 25 years, early movers who secure scalable, reliable power will gain a decisive competitive edge.

The Conversation

AI's promise lies in its ability to mimic human cognition—transforming industries by enhancing decision-making, efficiency, and creativity. As AI evolves from streamlining processes to replacing human tasks, its energy demands are soaring. Advanced models like GPT-4 reportedly require around 50 GWh of electricity—far exceeding earlier versions and signaling a fundamental shift in computational appetite. This surge not only redefines technological capabilities but also raises critical questions about sustainable energy use.

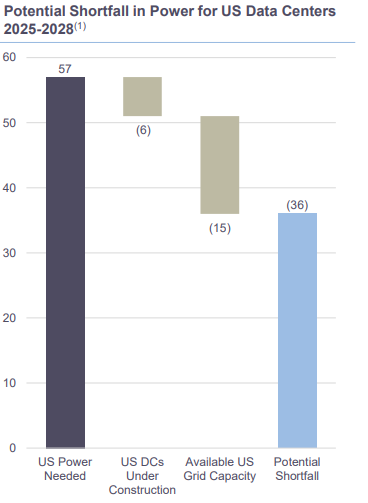

Meanwhile, the rapid expansion of data centers is straining aging power grids. In 2023, US data centers consumed an estimated 176 TWh of electricity, a figure forecasted to rise significantly by 2028. Projections indicate a potential shortfall of 36 GW by 2030, necessitating up to $1 trillion in investments for modernizing power generation and upgrading grid infrastructure. This dual challenge of escalating energy needs and outdated systems calls for innovative solutions in power management, improved cooling technologies, and smarter grid designs. As the digital revolution accelerates, aligning breakthrough AI advancements with a robust, sustainable energy framework becomes essential for long-term growth and resilience.

The Rithm Take

This evolving landscape presents a unique opportunity to integrate asset-based finance into the energy and data center shortage. By channeling capital into tangible, income-generating assets such as advanced data centers, modernized power grids, and next-generation energy facilities, one can build a resilient portfolio that underpins the digital transformation. Embracing these investments as part of an asset-based financing model not only secures stable, long-term cash flows but also transforms the energy and infrastructure build-out into a core driver of value creation.