Regime Shock (Or Maybe Not)?

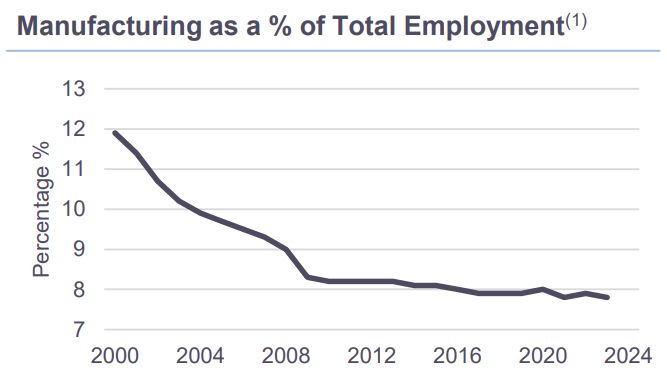

Tariffs are not new in American history. Dating back to 1890 from when President McKinley, then in Congress, pushed the first tariff bill through to the 2018 tariffs under President Trump, their outcomes are well documented. More immediately, the goal of growing manufacturing’s share of total employment comes at a time when the country is close to full employment and the skills gap in manufacturing has grown. After a battle to drive inflation down, imposing tariffs on consumption could drive up headline inflation, pinching the wallets of consumers at the grocery store and boosting US manufacturing costs given supply chain networks, particularly within North America.

The Conversation

The Tariff Act of 1890, known as the McKinley Tariff, was mentioned in President Trump’s inauguration address, "President McKinley made our country very rich through tariffs." At that time, a strong economy, budget surpluses and tariffs were seen as a way to reduce imports and, in times of lowering demand, reduce tariff revenues. When this occurred, however, inflation rose and impacted capital allocation, shifting to non-traded sectors spared from higher tariffs. McKinley said in a speech in 1901—a day prior to succumbing to a gunshot wound, "Commercial wars are unprofitable. A policy of goodwill and friendly trade relations will prevent reprisals."

The January 2018 20% initial tariff on residential washing machines is a more recent example of rising prices against a more subdued inflation backdrop. CPI for laundry equipment rose 18.3% between January and June 2018, and these prices were still up 13.2% yearover-year in December of that year. Denting demand, Whirlpool sales fell in 2018, 2019, and 2020 even as demand for goods surged and employee count dropped from 92k to 77k in two years. The stock price fell 36.6%, and the CEO who initially claimed tariffs were "without any doubt, a positive catalyst for Whirlpool," subsequently said, "the net impact of all remedies and tariffs turned into a headwind for us."

The Rithm Take

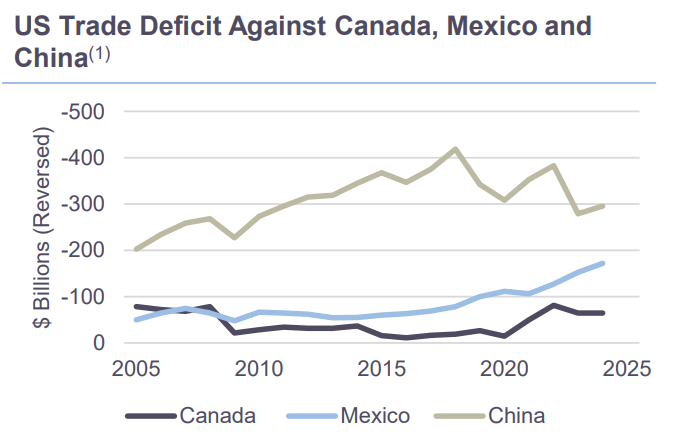

History may not repeat exactly, but it often rhymes. The recent round of tariffs floated—25% on Mexico and Canada, 10% on China—would impact a total $1.36tn (total imported from all three countries last year) in imported goods, if imposed. This compares to tariffs impacting $380bn(1) of goods in 2018-2019. De minimis exemptions are also now eliminated, previously sparing imports under $800. Subsequent analysis of the 2018-2019 tariffs concluded it as being one of the largest tax increases in the US in decades(1), reducing real incomes and adversely impacting GDP—not to mention driving election outcomes, too. The current round of tariffs has been sized at 1% of the 3% GDP run rate and is estimated to drive up inflation expectations as well.