Setting the Stage for a Rate Cut

The Federal Open Market Committee will conclude a two-day monetary policy meeting on Wednesday and it is widely expected that the Fed funds target range will be left unchanged at 5¼%-5½%. However, recent inflation and labor market data suggest that policymakers may be able to begin setting the stage for a rate cut at the September Fed meeting. Inflation has moderated further since the last FOMC meeting, and the unemployment rate has risen. Given the recent economic data, Fed officials have indicated that they are now focusing more equally on both sides of the dual mandate of price stability and maximum employment.

The Conversation

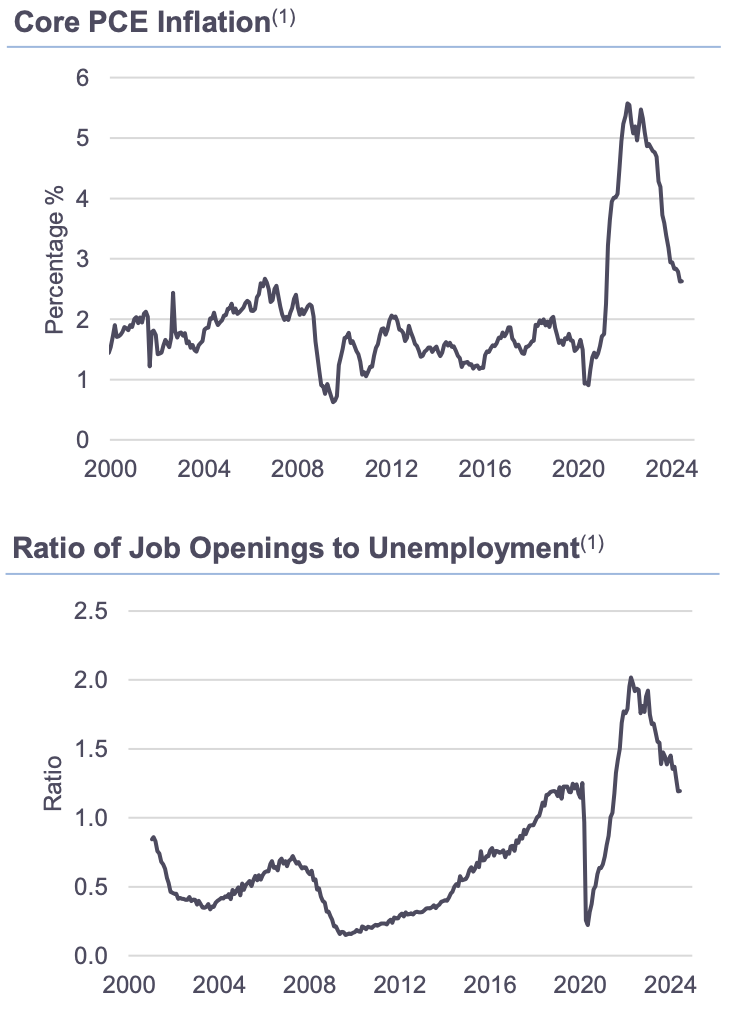

When the FOMC met in June, the year-over-year core PCE inflation rate was reported at 2.8%—down only slightly from 2.9% at the end of 2023—but today that rate is 2.6% (this compares to a peak core inflation rate of 5.6% in February 2022). The unemployment rate at the time of the June FOMC meeting was 4.0%—up from the April 2023 low of 3.4%—and this rate has edged higher to 4.1%. In Fed Chair Powell’s early July testimony to Congress, he said: “For a long time since inflation arrived, it has been appropriate to focus mainly on inflation. But now that inflation has come down and the labor market has indeed cooled off, we are going to be looking at both mandates.”

The cooling in the labor market is shown by the decline in the ratio of job openings to unemployed job seekers to 1.20 in June from 1.45 at the end of 2023 and a peak of 2.02 in April 2023. Payroll gains have also moderated to an average of 177,000 per month in the three months ending June, the slowest on this basis since January 2021. Fed Governor Waller said in a recent speech: “A continued decline in the job vacancy rate and the vacancy-to-unemployment ratio may lead to a larger increase in unemployment than we have seen the past two years. I see there is more upside risk to unemployment than we have seen for a long time.”

The Rithm Take

Fed officials continue to see a path to a soft landing, but achieving that soft landing may require a reduction in the degree of monetary policy restraint as inflation slowly moves towards the Fed’s target and the risk of a higher unemployment rate grows. Governor Waller said on July 17: “I believe the time to lower the policy rate is drawing closer.” The Fed may signal at the conclusion of this week’s policy meeting that if upcoming data reports indicate a continued easing in inflation and cooling in the labor market, a rate cut might be warranted later this year.