SRT Meets “Capital Recession”

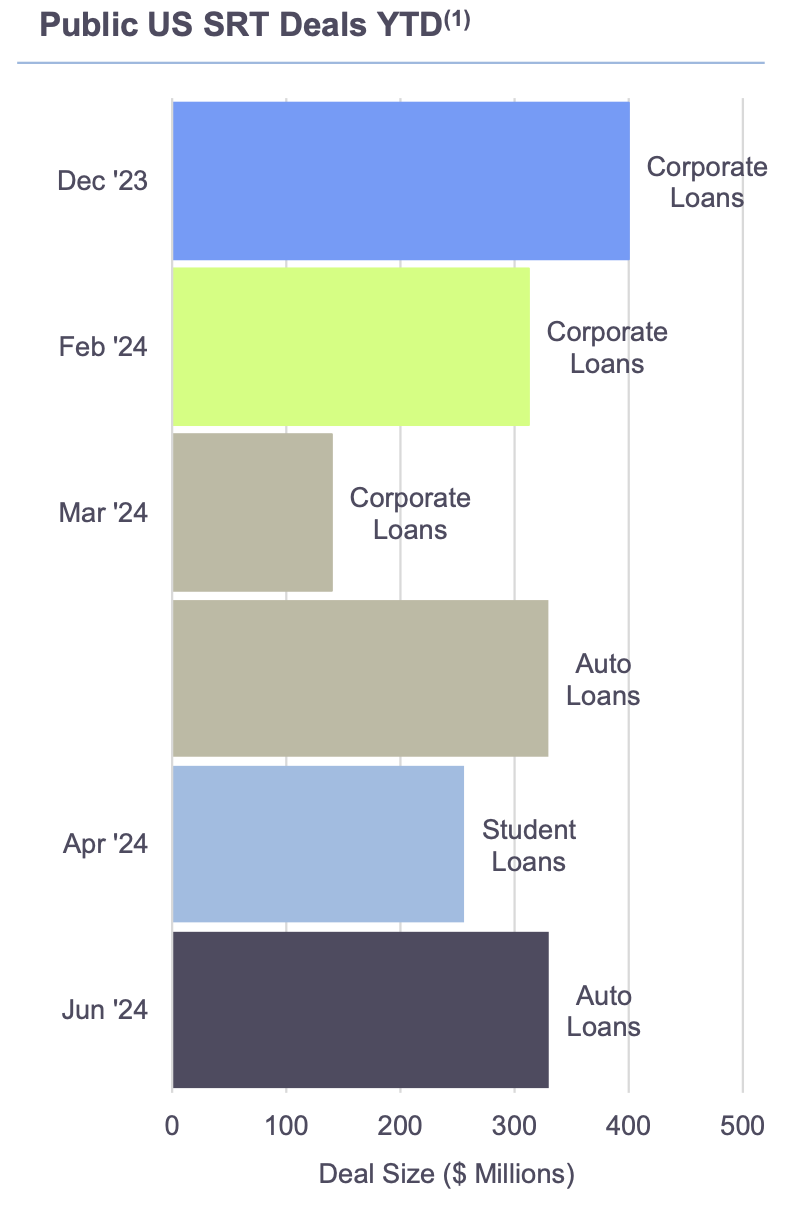

Synthetic, or as referred to in Europe, Significant Risk Transfer (SRT) transactions have seen a notable pick up this year in the US. This development has aligned with the “Capital Recession” theme we have outlined as ongoing with the various factors impacting bank balance sheets. The emergence of this product from bank sellers is symbolic of the transfer of assets to private entities through private credit and asset-based finance (ABF) channels.

The Conversation

SRTs are mechanisms to obtain regulatory capital relief by selling a portion of the risk to third party investors. While this product has been a mainstream in Europe, it has only recently gained traction in the US due to the introduction of Basel 3 Endgame (B3E) rules and the bank failures of SVB, FRB and Signature, as well as the restructuring of NYCB. The range of assets collateralizing these are broadening, starting from higher capital charged auto and student loans, to CRE, mortgage assets, subscription finance and warehouse lines. The variety of institutions issuing SRTs are also expanding including regional banks. Issued as public notes or privately placed, the outlook calls for growth in both supply and demand for SRTs.

Bank balance sheets are challenged by a multitude of factors. Some examples include:

a) Tighter bank capital rules (B3E)

b) Elevated commercial real estate (CRE) exposure

c) Impact from upcoming rule changes on reflecting All Other Comprehensive Income (AOCI) losses through equity capital

The severity of these factors has varying impact across banks of different sizes, from the largest to the smallest.

On any given day, a variety of statistics point to the concentrated exposure to CRE at the US regional banks. On other days, the structurally higher yields on government bonds have increased unrealized book losses in banks’ AOCI, which is likely to be recognized against equity capital due to new regulations. This is the “Capital Recession” in play in the banking system.

The Rithm Take

While the focus has been on bank capital, deposit flight in a higher-for-longer rate environment also presents additional liquidity risks, which was on full display during the SVB and FRB episodes. The post-pandemic era of high rates and deposit competition could not stand in more contrast than the post-GFC era of zero deposit rates and almost no competition for deposits, i.e., low deposit betas (change in deposits for unit change in rates). The two together is staged to force a shift in the bank asset mix, bank balance sheet structures and related supervisory concerns, adding new dimensions to the “Capital Recession” theme.