Tariff Impacts on Housing

Updated tariff rates of 125% (as of 4/9) on imports from China but 10% elsewhere (for 90 days at least), brings the average tariff rate to 26% based on 2024 import levels. This is estimated to put the total price shock at about $800 billion or about 2.75% on GDP, all else equal. The impact of these tariffs is not uniform across industries. Exceptions to Mexico and Canada are material to US housing.

The Conversation

The effective tariff rate on all imports has risen from ~2% coming into the year to about 26%. The industries with the largest impact of tariffs are expected to be capital goods, consumer goods, autos, industrial supplies, petroleum and food and beverages.

The National Association of Home Builders (NAHB) has estimated that $204bn of goods were used in the construction of both new multifamily and single-family housing in 2024. $14bn of these goods were imported from outside the US. This led the NAHB to estimate 7% of goods used in the new residential construction were from outside the US. Further, the NAHB estimates the average cost of a home will rise by $9,200.

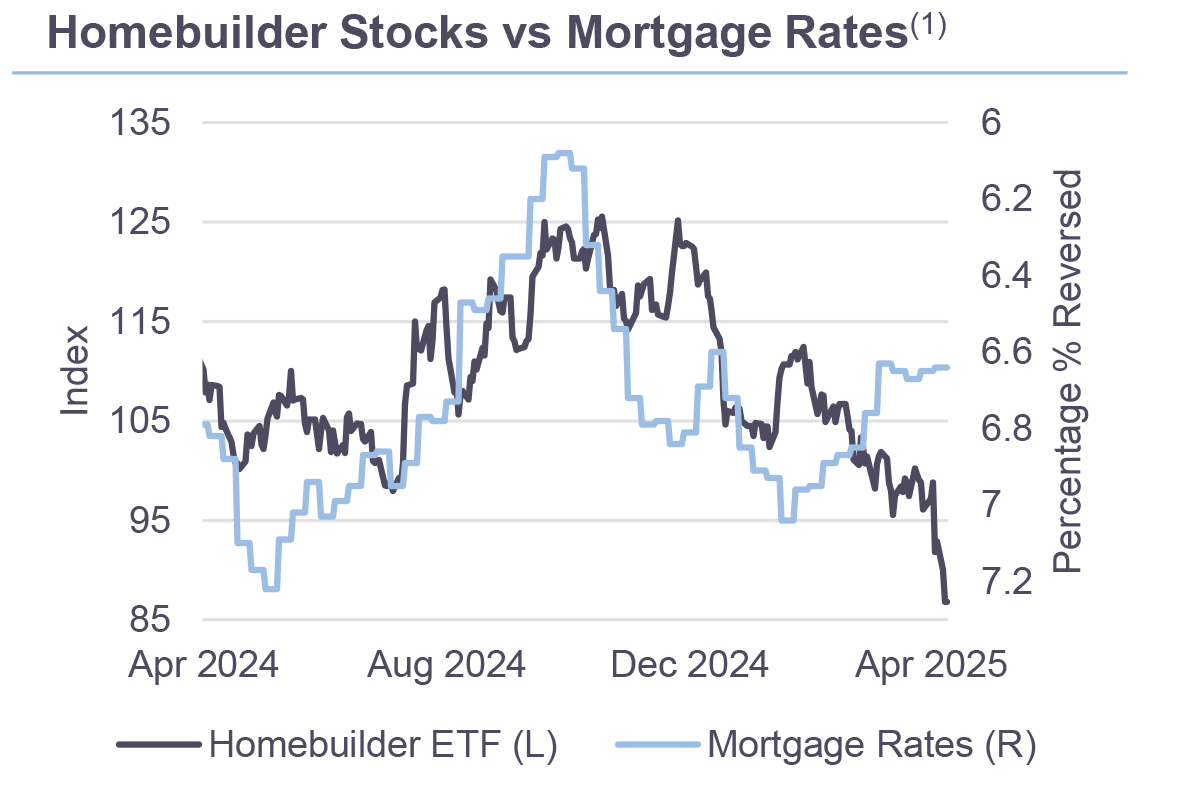

The exemptions to Canada and Mexico are material to housing. Materials like lumber, gypsum, concrete and metals are not subject to additional tariffs given USMCA exclusions. Tariffs on steel products, a third of which are imported from Mexico, Canada and China are exempt as well. Nonetheless, higher costs on construction will add to margin pressures for homebuilders, echoed in recent corporate guidance. Reflecting this is the valuations of homebuilder stocks, which have been steadily declining this year.

The Rithm Take

A risk to the current tariff regime, as relates to homebuilding and housing construction costs, is the 14% anti-dumping on lumber. This additional duty was already in place prior to the tariff announcements and the Department of Commerce is considering doubling it. Conversely, mortgage applications for both purchases and refinancings continue to climb, significantly exceeding the volumes recorded at comparable interest rate levels in 2024. Treasury Secretary Scott Bessent has noted this development, which may indicate a favorable outcome despite the steep downturn in markets and the marked weakening of overall sentiment. As the largest outlay for consumers, mortgage applications trends will be meaningful to watch heading into the spring housing season.