Tariff Impacts on the Consumer

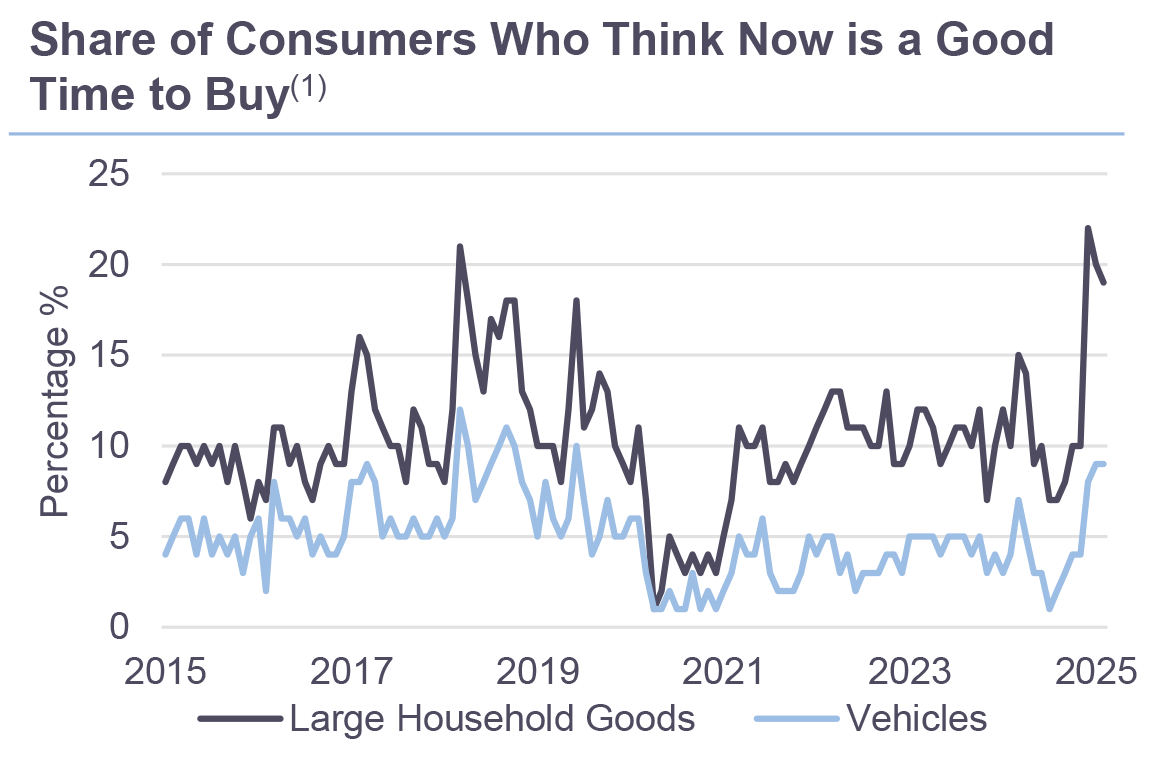

Consumers have been front loading purchases, expecting a hit from tariffs. Retail sales this Wednesday came in higher than expected, with a 1.4% month-over-month gain. Nearly 20% of consumers believe now is a good time to buy large household goods as prices are going higher, close to its highest point in 30 years, according to the University of Michigan March 2025 Survey of Consumers. Price increases from tariffs are coming at a time when debt laden consumers are already weighed down.

The Conversation

After declining in January and February, durable spending rebounded in March. This is driven partly by a surge in loan applications, following the March 26 announcement that vehicle and vehicle-parts tariffs would take effect on April 2. Vehicle loan applications jumped 23% year over year between March 27 and April 1. Bank of America’s proxy for durable spending—which covers auto parts, furniture, electronics, and building materials—rose 1.5% in March after two months of declines. Within total card spending, retail spending (excluding gas and restaurants) increased 0.5% month over month in March, while overall services spending only inched up 0.1%. During February and March, consumers pulled back on “nice to have” spending—such as dining, travel, and leisure—and redirected funds toward durables likely to be affected by tariffs.

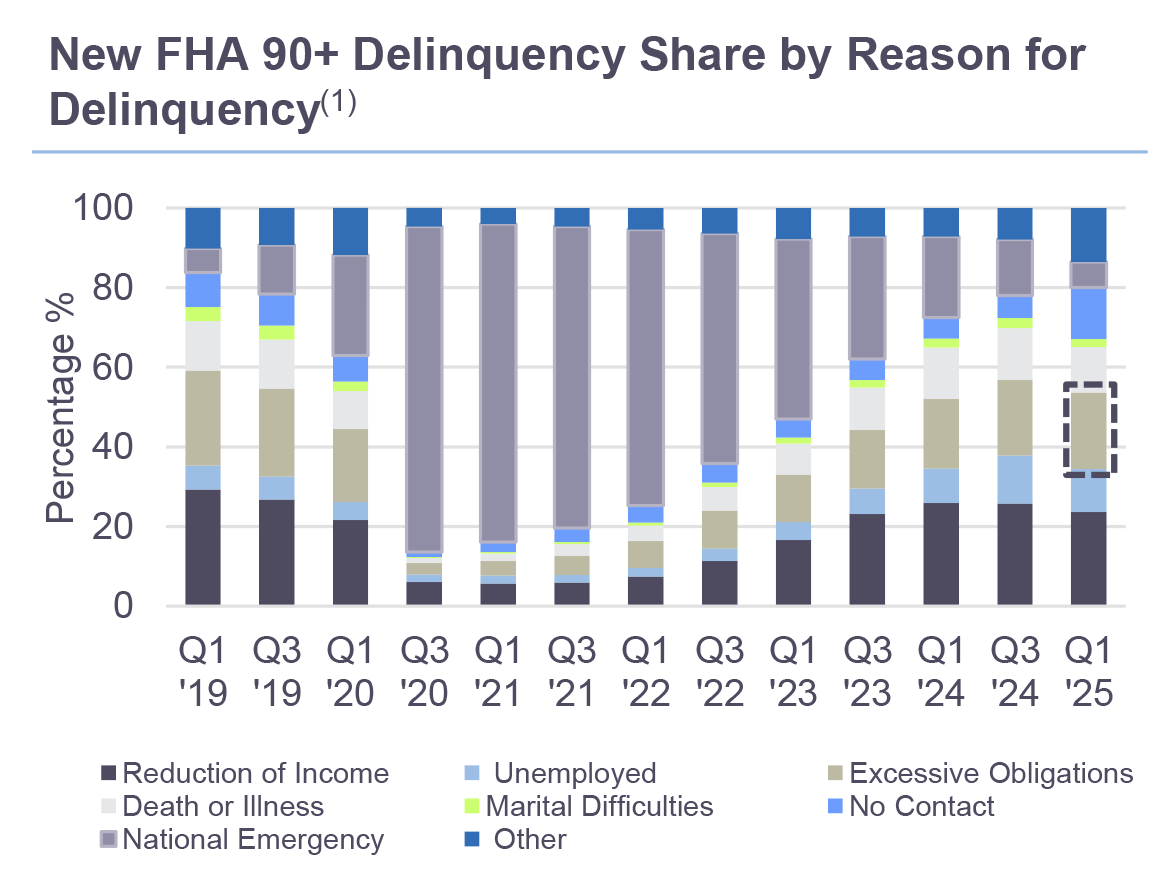

The impact of tariffs are likely to be largely shouldered by the American consumer, as businesses pass on costs. The accelerated spending only speaks to price sensitivity amongst consumers. This is all coming at a time when the weight of any added costs is showing up in rising delinquencies on credit cards, autos and student loans. “Excessive obligations” are cited as a growing part of the FHA’s seriously delinquent loans. While these trends are normalizing to pre-pandemic levels, they expose mounting signs of an increasing “DTI stretch.”

The Rithm Take

As a Rule of thumb, income leads spending, spending leads delinquencies, delinquencies lead credit scores. Personal income trends have been stable, rising at slightly above 2%. Spending is accelerating, pulling consumption from quarters ahead, especially as tariffs take hold. This notably includes de minimis items that were previously exempt and mostly from China, where the tariffs rate now stands at 145%- 245% depending on the good. We are keeping a close watch on the drivers of delinquencies as the consumer credit cycle adapts to this new regime.