Tentative Fed to Await an All-Clear to Ease

At the conclusion of the Federal Open Market Committee's two-day monetary policy meeting on Wednesday, it is highly likely that the Fed funds target range will remain at 5¼%-5½%. Although core CPI inflation eased to 3.8% year-over-year in February from 3.9% in January, inflation persists at elevated levels, with a slower pace of moderation evident in early 2024 compared to the peak core inflation rate of 6.6% in September 2022. The latest employment report paints a murky picture of the labor market, making the payroll and household employment picture similar to the divergent growth picture from expenditure versus income-based GDP measures.

The Conversation

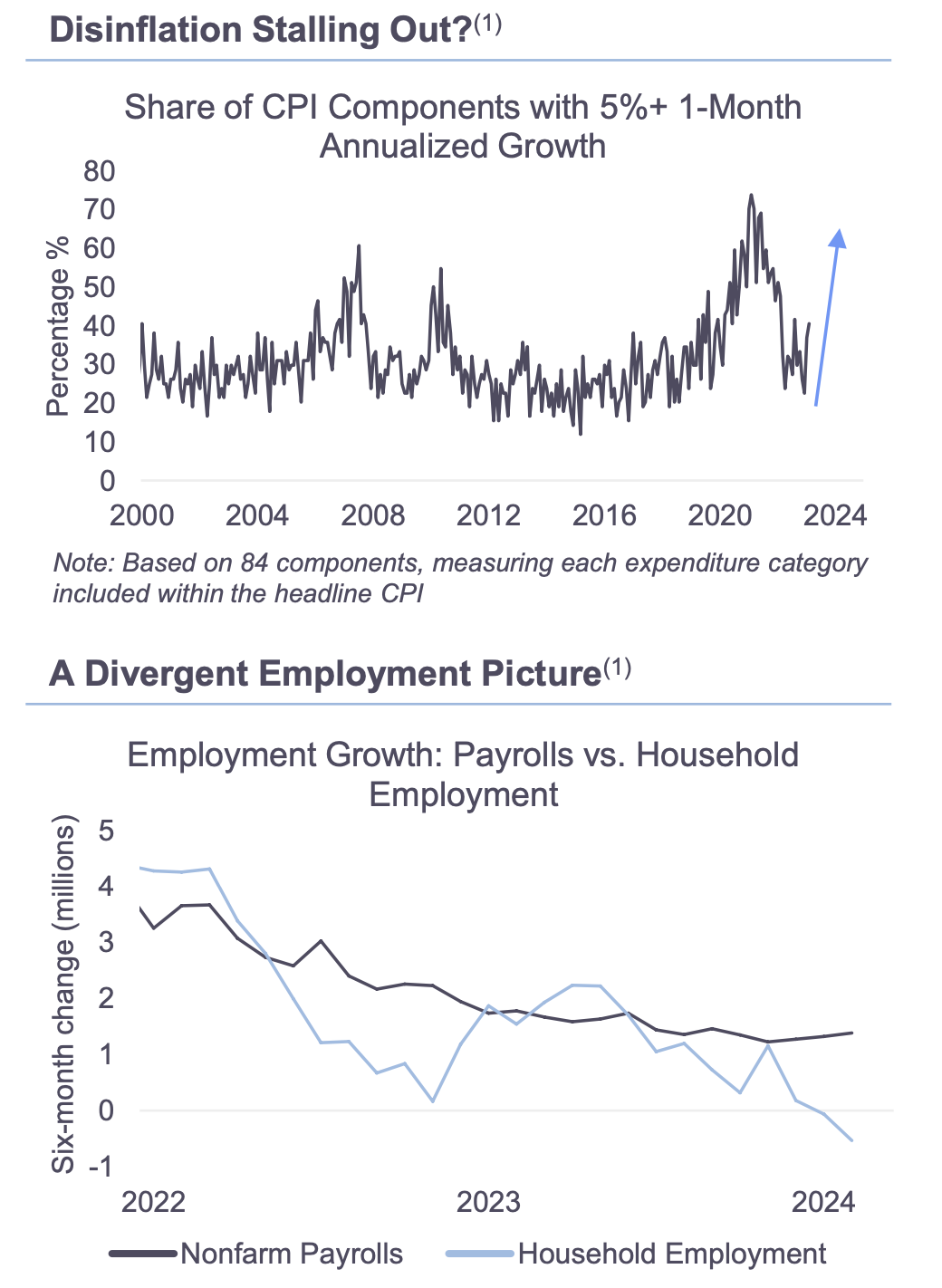

The disinflation indicated by late 2023 inflation reports has not continued into early 2024. Core CPI prices rose 0.4% in both January and February, and alongside the faster momentum of price gains, the breadth of inflation components showing rapid price increases has also increased. Although year-over-year core CPI inflation eased to 3.8% in February, the three- and six-month annualized inflation rates stand at 4.2% and 3.9%, respectively. The early-year core inflation pickup may be partially due to inadequate seasonal adjustment factors.

The labor market picture is also unclear. Although nonfarm payrolls have risen by 1.4 million over the last six months, household employment has declined by 532,000. Strong payroll growth has also been relatively narrow by industry, with 1.0 million of the 1.4 million payroll positions created over the last six months concentrated in government, health care and leisure and hospitality sectors.

During his early-March testimony on monetary policy, Fed Chair Powell stated, "If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year… [but] The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent."

The Rithm Take

Given an unclear picture of both inflation and employment trends, Fed officials will need to see more data before gaining confidence that economic conditions warrant a rate cut. Interest rate futures markets have repriced to what we believe is a more realistic path for the Fed funds rate with the initial rate cut now expected at the June FOMC meeting (in January, the market was priced for a cut in March), and three quarter-point cuts expected this year (versus the almost seven cuts that were priced in earlier this year). Incoming data on inflation and the labor market will remain an important focus for both policymakers and market participants.

1. Source: Bureau of Labor Statistics.

This Rithm Market Update is provided in partnership with RDQ Economics. For any further questions about Rithm Capital or this article, please reach out to ir@rithmcap.com. This article is being provided for informational purposes only. It may not be reproduced or distributed. No representation is made regarding the accuracy or completeness of the information contained herein. Nothing contained herein constitutes investment advice nor an offer of securities