The US Consumer: Onward, Forward, Upward

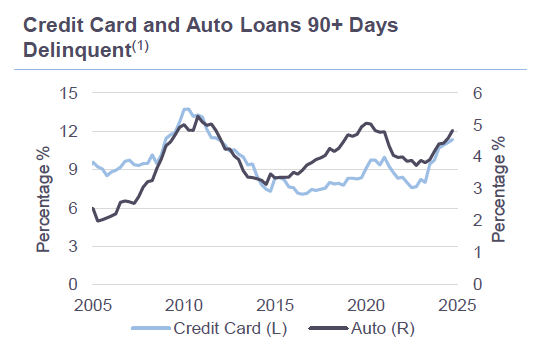

Real consumer spending contributed 2.1% percentage points to total real GDP growth of 2.5% in 2024. Momentum strengthened as the year progressed with, Q4 real consumer spending growth at 3.2% compared to an average of 2.8% for the prior three quarters. Despite this strength, consumer delinquency trends are flagging growing stress across several credit lines, most notably rising in auto and credit card loans. This comes against the backdrop of real wage gains of 3.2%, low unemployment rates, a personal savings rate of 4.1% and declining debt levels as a share of income. Although the savings rate is low, households are spending a high share of their income. Savings from their stock holdings, home equity, retirement funds, etc. are at all time highs.

The Conversation

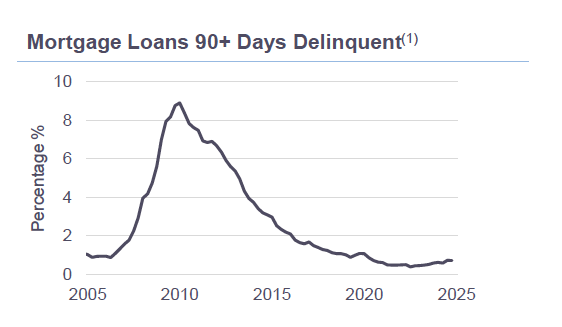

The economy goes where the consumer leads. In the backdrop undermining consumer strength, is the trend of rising delinquencies. Examining these trends more closely shows delinquencies are normalizing back to prepandemic levels as the government stimulus and excess savings wear off.

More nuanced and relevant for specific credit lines are factors ranging from debt prioritization, ability (income, savings, credit quality and debt levels) and willingness to pay (secured, unsecured, loan-to-value (LTV) ratios). Government stimulus checks resulted in FICO inflation on unsecured borrowers, which is now impacting these borrowers’ ability to pay.

Debt prioritization favors mortgages. Willingness to pay is high as prices have risen and LTV ratios decline. Even so, delinquencies have been rising. Geography is playing a more important part than usual. Leading these trends is performance in areas like hurricane ravaged Florida and oversupplied Texas, which are seeing higher delinquencies as a result. Low housing affordability is being further challenged by rising insurance premiums, homeowner’s association fees and higher property taxes on home value gains.

The Rithm Take

Rising delinquency trends will require careful ongoing analysis. Credit performance is normalizing. Pockets of rising delinquencies can be explained by FICO inflation, geography and loans originated after the Fed started to raise interest rates. Even in credit lines like mortgages, on top of a household’s debt prioritization list, delinquencies on post-2022 originations can be explained by added debt burdens. These rising outlays can be housing related or come from other credit lines, such as the resumption of student loan payments. As FICO inflation wears off, a “higher for longer” environment could bring more evidence of “Debt-to-Income (DTI) stretch” which remains localized and situational for now.