Unprecedented Resilience Across Corporates and Small Businesses

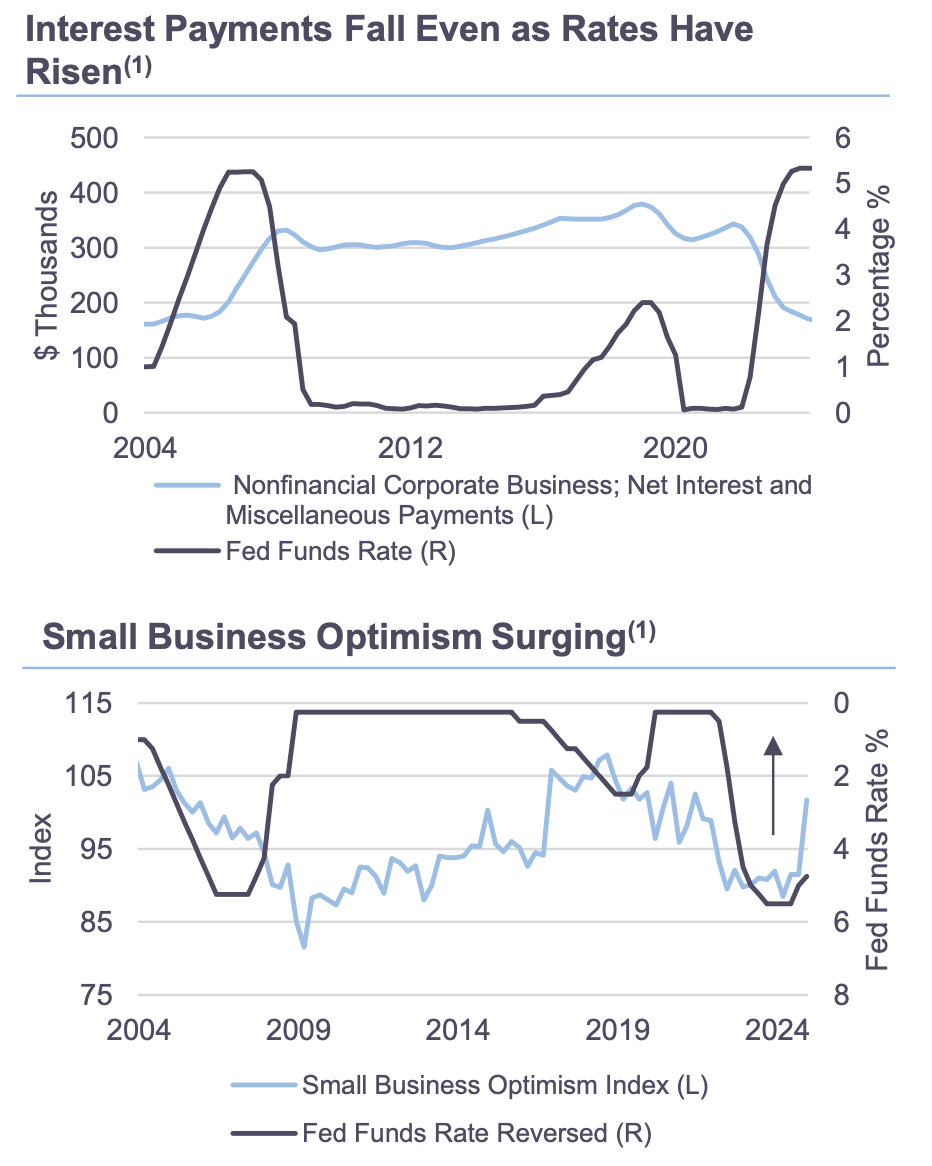

As 2025 begins, the US economy is demonstrating a strengthened and broadening resilience in the face of uncertain fiscal and political outcomes. This strength spans across corporations, small businesses, and households. Unlike previous cycles of Federal Reserve tightening, corporate outlays to cover debt is falling. Small business optimism post-election continues to grow into 2025. Meanwhile, households are benefiting from rising stock market valuations, enhancing the wealth effect. Despite the Federal Reserve’s shift toward easing, long-term bond yields are rising, reflecting higher real rates which may be needed to get inflation down to the 2% target.

The Conversation

Credit spreads are tight. Better quality is being cited, especially in the publicly traded high grade and high yield sectors. Evidence of this is seen in declining corporate outlays to cover interest expenses. Breaking from historical trends is the absence of monetary policy transmissions, which have previously led to rising interest outlays on Fed tightening. This provides a strong fundamental driver for tight credit spreads being sustained.

The Small Business Optimism Index breaking above the 100 level has previously coincided with either easing monetary policy or with business-friendly election outcomes, as was the case in 2016 and now 2024. With just under 50% of the US labor force employed by small businesses, we look to employment composition broadening as evidence of this strong sentiment.

Wealth effects from rising stock valuations and home prices are contributing to consumer spending power and demand for services. Total US household wealth has now surged past $150tn, multiples of US GDP. This week’s surge in the ISM Services Prices Paid Index, if sustained, poses a challenge to the market narrative of steady declines in inflation that have been baked into expectations.

The Rithm Take

Continued evidence of economic resilience is reinforcing the expectations for a “higher for longer” regime. This resilience raises the bar for the Fed to continue cutting rates into 2025. Markets continue to price these factors into a continued bear-steepening of the yield curve which will cause knock-on effects. This challenges the “extend and pretend” strategies enacted on commercial real estate exposures on bank balance sheets and a possible realization of losses. Adding to this renewed pressure on bank balance sheets is the magnitude of unrealized losses on Available for Sale and Held to Maturity positions with higher long-term rates. Even with regulatory pressures expected to loosen for bank capital treatments, asset-liability management will continue to delay bank sponsorship of agency MBS and shift other loan products to private credit and ABF (Asset-Based Finance) channels.