When Will the 10-Year Yield Backup Matter?

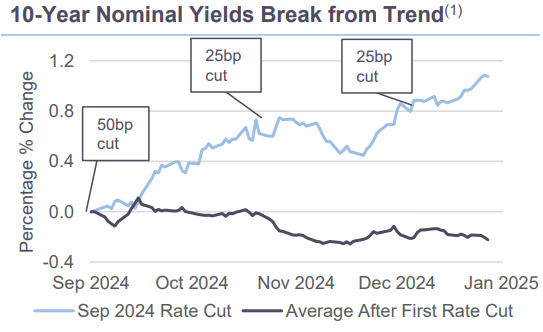

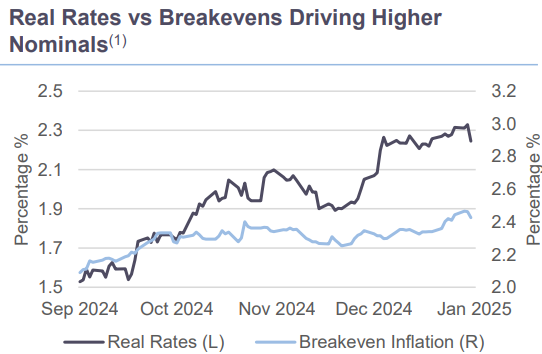

Since the mid-September FOMC, which marked the start of policy normalization, the 10-year Treasury yield has behaved unusually, moving higher rather than lower. The over 100 bps move in nominal yields has largely been driven by a move higher in real rates rather than a rise in breakeven inflation. This week’s inflation readings have triggered a reversal lower in yields but moves ahead merit watching for broader impacts across assets.

The Conversation

As the Fed has delivered a cumulative 100 bps of easing in a process to normalize policy to being less “restrictive”, the 10-year nominal yield has risen over 100 bps. Most of the rise in nominal yields has come from a marked step up in real rates, about 70bps of the 100bps. The remainder has come from a gradual increase in inflation expectations.

Rising real rates may well be a signal that a higher level of rates are needed to cool inflation down to the 2% target. Sticky inflation as well as productivity gains in the face of the cumulative 525 bps of rate hikes, support the case for further economic resilience.

The rate hiking cycle has created an environment that incentivizes consumers to increase savings. It could be that in order to sustain the continued economic expansion, higher real rates are required, hence the rise in nominal yields.

Until now, risk markets have broadly tolerated this surge in yields. We are focused on separating signals from noise ahead.

The Rithm Take

This week’s inflation data has triggered a rally, as the market has perceived moderating trends. However, at best, the data shows a leveling off with 3, 6, and 12-month core CPI at 3.3%, 3.2% and 3.2%, respectively. In the meantime, inflation expectations have risen across several surveys; the University of Michigan consumer survey shows 5-10 year inflation expectations rising to 3.3%, a 16-year high. The ISM Services Prices Paid Index, which often leads headline CPI, has also surged. Should these translate into a marked repricing in the market’s inflation expectations, specifically the 10-year breakeven inflation above 2.6%, we expect higher volatility and a repricing across risk assets as the market narrative possibly then shifts into pricing rate hikes.